Are Central Banks and Global Companies Diversifying out of U.S. Treasury Bonds - to U.S.$-backed China Bonds, to Gold, and to non-U.S.$ Currencies?

Are the Negotiations on the U.S. Tariffs including an implicit Plaza Accord 2.0 through the strengthening of non-U.S. Dollar Currencies? What are the Investment Implications?

Negotiations on U.S. Tariffs - Implications to the U.S. Treasury Bonds and to the U.S.$

In prior postings we have written extensively on the U.S. Tariffs. We are currently seeing the following trends:

U.S. using the tariffs to economically isolate China.

U.S. tariffs becoming more complex and convoluted, with exemptions on some goods and services and with tariff rates dependent on the country of origin. This is causing considerable burdening overhead cost as ports are now spending considerable time in assessing rates, collecting tariffs, and complying with the extensive set of new trade-related regulations.

U.S. trading partner negotiations beginning to use their holdings in U.S. Treasury Bonds as a card and negotiating tool. Meaning threatening to sell U.S. Treasury Bonds if negotiations are not favorable withe U.S., and meaning a willingness to continue buying and holding U.S. Treasury Bonds if negotiations are favorable with the U.S..

Let’s take Japan as an example:

Japan Warns Bessent With Major Treasury Dump - link here:

Japan is actually seeing benefits to its industry in selling U.S. Treasury Bonds. Here is the process they are taking, ensuring also the repatriation of the funds does not adversely strengthen the Japanese Yen currency:

Now an emerging trend in the trade and tariff negotiations could be a trend to a Plaza Accord II re-valuation of the currencies of U.S. trading partners, similar to what happened in Plaza Accord I back in 1985. This strengthening of the U.S. trade partner currency may be being demanded by the U.S. as part of a trade deal. Or the currency strengthening may simply be the result of repatriation of sold U.S. dollar denominated assets back to their home country.

Countries finalizing trade deals with the U.S. may also be taking the approach of Japan but may also be limiting the currency sterilization process to allow their currency to strengthen somewhat relative to the U.S. dollar.

Here are charts of the Taiwan Dollar and the Korean Wan - given Taiwan and Korea would be in trade deal negotiations with the U.S.. We will monitor this potential emerging trend to see if it continues, and analyze to determine the causes and motivations.

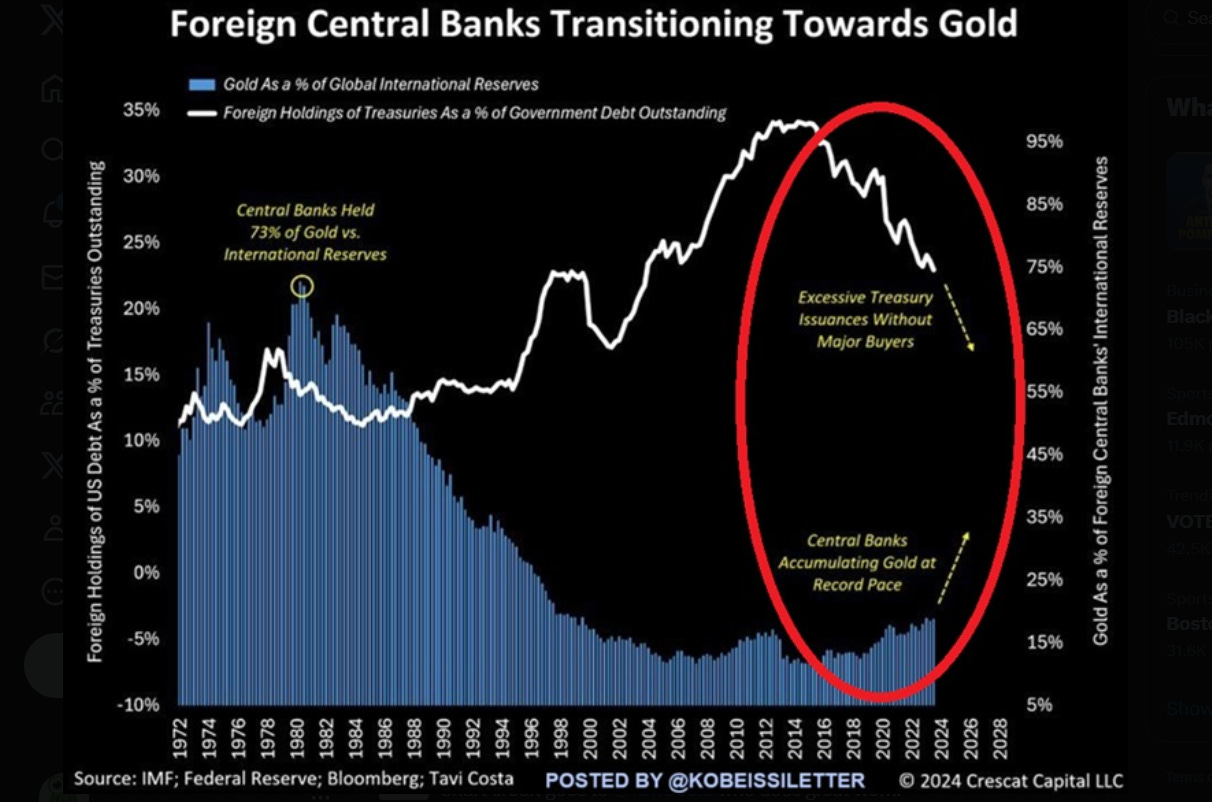

As a follow-up to our recent posting on “Is Capital Fleeing the United States” (see below), let’s do a focus on the “fleeing” from U.S. Treasury Bonds and the “fleeing” to gold by central banks.

Is Capital Fleeing the United States?

Over the past couple weeks, the U.S. markets have been very volatile but a potential new trend needs to be followed closely as the implications are very dire for the U.S., especially given its target goal of re-shoring jobs and fostering a manufacturing renaissance.

Central Banks Buying Gold as a Neutral “Reserve Currency” Asset

Indeed foreign central banks are transitioning towards more holdings of gold as a neutral “reserve currency” and less of holdings in U.S. Treasury Bonds:

In terms of central banks buying gold versus buying sovereign government bonds (in particular U.S. Treasury Bonds), one of our Most Admired Advisors (MAA) Louis-Vincent Gave strongly feels that gold is becoming more of the go-to asset in this regard. Gold is a neutral asset and not subject to being leveraged politically like U.S. Dollars and U.S. Treasury Bonds, and not subject to potential asset freezing or asset confiscation by the U.S. government, and especially now that MAG7 tech stocks like Nvidia and Tesla, which also have served as “reserve” assets in a manner similar to U.S. Treasury Bonds, are imploding:

A key point Louis-Vincent makes is how global central banks, governments and foreign financial institutions are asking themselves why should I buy U.S. Treasury Bonds if the U.S. is unable to provide me security and protection? “May as well buy commodities and build up inventories and let go of all these excess U.S. Dollars.” Louis-Vincent references this speech by a former U.S. Navy SEAL officer Erik Prince, highlighting how the U.S. is losing its military dominance and global expertise through innovation and asymmetric warfare technologies:

Re-Dollarization in addition to De-Dollarization

In addition to the trend of de-dollarization, there is also a trend in re-dollarization. Meaning there is an emerging trend of buying of U.S.-dollar denominated sovereign government bonds - but instead of through U.S. Treasury Bonds, it is through U.S. dollar denominated sovereign government bonds issued by China.

Watch this great podcast by Economist Sean Foo focusing on the China is borrowing in U.S. Dollars cheaper than even the U.S. Treasury, this is a big emerging trend, as the implications are potentially enormous, given the rising challenge by the U.S. to rollover its current massive debt and to get a bid on new debt:

For many years global central banks and governments have recycled their excess U.S. Dollars into U.S. Treasury Bonds, partly to help keep their home currencies weak for global export advantage. Now China is offering an alternative, basically saying “Buy U.S. dollar-backed China Sovereign Bonds from us at the same yields instead of buying U.S. Treasury Bonds to minimize the political and legal ramifications associated with U.S. Dollar assets”:

Here are some observations by Eric Yeung, an astute China observer:

The big question - will central banks and other organizations continue to buy gold and/or will they begin diversifying into other assets (and which assets in particular?) - find out more on this in this next section on our investment approach and portfolios.

Implications to our Investment Approach and Portfolios

Let’s delve in …

Become a paid subscriber today for access to the below, and to our entire postings, and to our model portfolios - for our best offer of less than $5 dollars a month - only $4.92 per month.