Get to Know The CedarOwl

Investing in Positive Ideas - Publication on finance, economics and innovation that seeds a silver-lined tomorrow.

We are a group of visionary consultants from around the world, with extensive experience internationally with top industry firms and other organizations. We provide C-level consulting services to industry firm senior management, financial advisors, institutions and family offices. We provide strategy, direction and vision to address some of society's most critical challenges. We publish every Thursday.

Scroll on to learn all about us.

Introducing CedarOwl

Our work is founded on the basis of two unique approaches:

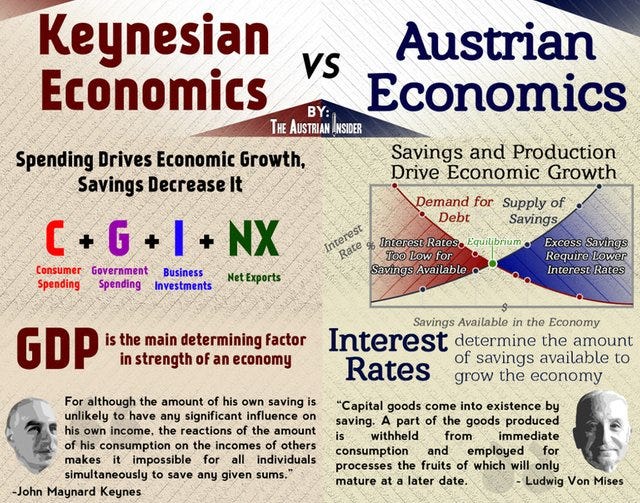

The principles of the Austrian School of Economics and

The principles of Market Environmentalism which is based on the Austrian School of Economics.

We emphasize a dual mandate of both targeting outperforming portfolio returns and also helping society and the environment at the same time.

In a nutshell, CedarOwl is Investing in Positive Ideas - ones we want to share with you, our readers.

Our Website and About Us - The Cedar Portfolio

CedarOwl is read by decision makers, fund managers, economists and asset managers from around the world - and through our podcast program show partners, in which we regularly interview many of these global gurus, and our content services integrate these interview discussions. Our Most Admired Advisors (MAAs) Report is like listening in to a board of advisors who we think have the best insights and investment ideas globally.

CedarOwl is also widely followed by investors seeking to learn from our research on our income-focused, wealth preservation and growth-focused portfolios. Retirees to high net worth investors to fund managers and asset managers may learn and benefit in a variety of ways from our publication.

Associate us as the essence that precedes the current Solar Punk and Bloomer (read: sunny side of the doomerism coin) movements that seek to identify, magnify and further create opportunity as we evolve as a society that reaps prosperity by investing and innovating alongside the environment.

They say “reap what you sow” - and lately, we see society in general sowing a lot of pessimism and fear. The dominating solutions and zeitgeist of perspective surrounding very real economic and environmental issues and challenges seem to echo this pessimism, trending in a bleak and contracted direction. Environmentalism now more than ever needs to be decoupled from the current agenda-based solutions -which contract freedom and opportunity of the masses.

Here in our publication, enjoy a weekly focus on tangible, positive ideas, cyclical updates on crucial micro and macro trends within the global markets, insights from our category’s thought leaders and perspectives emphasizing Market Environmentalism and the Austrian School of Economics within our commentary.

What is our Mission?

CedarOwl keeps a birds-eye view on the global economy, financial markets and innovation worth investing in for a green and prosperous future. Our mission is to shine a light on innovative and profitable answers to the question: How can our global society transition into a silver-lined, sustainable future through technological advancement, idea sharing and investment?

What Do We Offer?

Weekly content - released every Thursday - ranging from financial category reports to investment articles and editorial content, cycling though the following pillars:

Key Trends and Opportunities - Where economy, finance and environmentalism meet. An emphasis on positive ideas the make sense financially, economically and environmentally.

Most Admired Advisors Report (MAAs) - Top 10 who we think are the best thought leaders in the global finance and economist categories, their recent insights on the economy, the financial markets, investment ideas, as well as micro & macro trends.

The Cedar Portfolio and the CedarOwl Portfolio - Our full portfolio and a subset of the portfolio emphasizing a “gold mine” of income-focused, high-dividend paying companies from around the world. Link here to our portfolios.

CedarOwl Live Geopolitical Investor Risk Table: Available to the public, our live Risk Table evaluates a wide range of geopolitical risks, including government fiscal policies, central bank actions, and regulatory changes, with a dedicated chat for all subscribers to discuss at any time. The table is updated frequently and refreshes.

What Substantiates Us?

We are a group of visionary consultants from around the world, with extensive experience internationally with top industry firms and other organizations. We provide C-level consulting services to industry firm senior management, financial advisors, institutions and family offices. We provide strategy, direction and vision to address some of society's most critical challenges.

We are joined online by a cohort of great authors and like-thinkers across other publications and platforms.

Why Should You Subscribe?

All subscribers will enjoy great insightful and educational content on our postings. We structure our postings to have value to all subscribers - both paid and free.

Our paid subscribers gain access to the full scope of our content, reports, chat and comments section. The value here is a constant resource on cutting-edge insights that help add value to your personal and professional positions in finance.

CedarOwl is also place to share ideas and seed discussion as economics and environmentalism - chock-full of wicked problems worthy of conversation. The global economic distribution is changing more rapidly than ever and we invite our readers to lucidly join us along the ride.

What’s CedarOwl Powered By?

The Austrian School of Economics

The Austrian School of Economics (ASE) emphasizes savings and investment, with minimal debt and leverage, and maintains that policy changes which allow markets to operate freely result in economic growth and wealth creation, whereas interventionist policies are not friendly to the markets and result in economic stagnation and wealth destruction. Profit opportunities exist when these changes are anticipated and interpreted properly, and when identifying cash-flowing businesses characterized by scarcity, innovation, longevity and growth in value.

Source: The Cedar Portfolio

Market Environmentalism

Market Environmentalism is based on the principles of the Austrian School of Economics. There are four principles to Market Environmentalism. In the coming weeks we will be featuring relevant examples of innovations, entities and practices that support each principle. Let’s look at each of these below:

Principle 1: Market Economy

Economic and environmental success are not mutually exclusive. While many claim the “market approach” has been tried, it is a “crony approach” that has often prevailed, marked by fossil fuel subsidies, energy monopolies, and regulatory capture. The freer an economy, the better its environmental outcomes. As economies grow richer, they become more efficient and environmentally conscious, which leads to a gradual decoupling of economic growth and pollution. Only the market economy’s dynamic nature incentivizes entrepreneurs to do “more with less” and to create innovations that limit our ecological footprint. Free trade is crucial for both innovation and cooperation between people around the world, to jointly tackle environmental challenges.

Source: The International Declaration on Market Environmentalism

Principle 2: Private Property Rights

Property rights provide the incentives for both environmental sustainability and accountability. That which no one owns, no one cares for. In contrast, ownership stimulates stewardship and responsibility. Strong property rights also include the ability to trade resources, which allows for markets to reallocate natural resources for conservation purposes.

Source: The International Declaration on Market Environmentalism

Principle 3: Decentralization

Many environmental challenges are communal in nature, and local communities are better placed than governments to manage their shared resources. Where central planners lack the on-the-ground information, communities benefit from the dynamic, decentralized knowledge necessary to implement effective conservation strategies. Decentralizing power from government bureaucracies to local communities fosters closer cooperation, resource management, and environmental accountability.

Source: The International Declaration on Market Environmentalism

Principle 4: Optimism and Innovation

Nihilism, degrowth, and misanthropy are the enemies of the environment. We must embrace optimism and the power of innovation to achieve real change. Humans are not a plague on the planet but rather the “ultimate resource,” capable of bringing forth innovative ideas and solutions to protect our environment. Environmental challenges can be solved through innovation, technological progress, and entrepreneurship—while rejecting alarmist and unscientific approaches.

Source: The International Declaration on Market Environmentalism

Objectivity Amongst a Political Dichotomy

The economic landscape is changing and with that there is a lot of uncertainty. We want to stick to the facts economically and financially speaking.

We are aware of the political implications of Market Environmentalism and so exist in a dichotomy. Let’s parse through that here:

We believe that the four Principles of Market Environmentalism implore people of all camps to explore how this integration can have a positive impact, rather than seeing it as a subtractive argument ‘against’ other solutions. Instead, it represents a key to unlocking temperance. Various policy agenda items and landscapes could shift drastically if we all did our part to uphold all four Market Environmentalism principles in our current societal framework and investments. We strive for solutions helping the environment that make not only environmental sense but also make financial sense and economic sense.

Investing in Positive Ideas - Innovation & Technology

Think images of solar punk, tempered bloomerism and silver linings. We take a hyper-real look at the landscape and, through due diligence and research, identify areas of investment which have the potential to turn a more-than-respectable profit. We shine a light on technologies, innovations and practices that will improve quality of life on our planet, targeting outperforming opportunities of upside for us as investors. We love investing in win-wins.

On Sunk Costs, Bandaids Over Pullet Holes and Trojan Horses

Market Environmentalism has been conflated with initiatives like carbon credits, which we are not in support of here at CedarOwl. Why not strive to lower any pollutants into the environment in an absolute sense, instead of assuaging conscience through forgiveness payments in the form of carbon credits?

We believe that rather than necessitating and then punishing the subsequent use of fossil fuels, we should be looking for innovations that do not operate on punishment. Year 1 university education teaches us that negative punishment conditioning is generally the last resort recommended by behavioural psychologists. When we consider the entire approach, it is our hope that new perspectives and avenues can become available which yield positive environmental outcomes while maintaining dignity and satisfaction societally.

It is important for us to weigh out various options in the pursuit of environmental wellness, tempered with the cost to our society’s health, happiness and freedoms.

Inevitably, governments, agencies and various other organizations will put resources into proposed solutions, much like a pilot episode gets green-lit for a trial season. However, if we start to see that the implications of this system will be detrimental to society’s faith and function, this is a glaring warning to either pivot or cancel.

We cannot let sunk-cost fallacies rule the decision making process of major global implementations. Society functions better when people remain hopefully engaged, and that requires empathetic design.

Subscribers, get involved in the conversation in the comments. This is an exclusive space for you and other dedicated readers to seed conversation.

Disclaimer: The information and material provided (“Information”) on the CedarOwl substack is of a general nature and is intended for educational purposes only. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. The Information provided does not constitute a recommendation or a solicitation or offer of the purchase or sale of securities. Furthermore, the Information does not endorse or recommend any tax, legal, or investment related strategy, trading related strategy or model portfolio. The future performance of an investment, trade, strategy or model portfolio cannot be deduced from past performance. As with any investment, trade, strategy or model portfolio, the outcome depends upon many factors including: investment or trading objectives, income, net worth, tax bracket, suitability, risk tolerance, as well as economic and market factors. Economic forecasts set forth may not develop as predicted and there can be no guarantee that investments, trades, strategies or model portfolios will be successful. All Information has been derived from sources that are deemed to be reliable but not guaranteed.