Global Currency Collapse in the Near Future?

How are we positioning our Portfolios to address this?

We are seeing a global currency crisis in the near future. How will this happen? When will this happen? What are the economic and investment implications? Let’s provide consideration on these questions.

Drivers and Catalysts

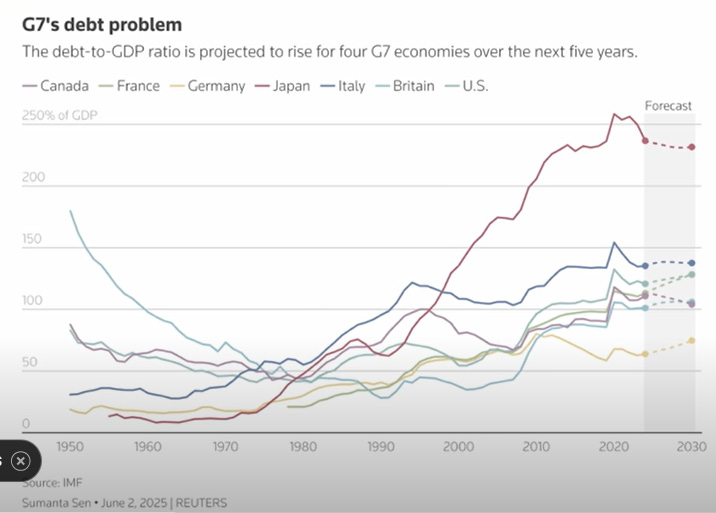

The biggest driver is the massive, unsustainable government debt in the G7 world:

Through representative democracy, and especially since World War II, many politicians have been able to get elected by promising many services and handouts for free while piling on debt with (in most cases and many will say in all cases) no intention to pay back the accumulated debt.

Historically governments take the easiest way out of debt - they generally don’t default, they generally don’t become fiscally prudent by cutting expenses, they generally could raise taxes, they generally don’t grow out of it - none of these options generally happen - instead, they rev inflation higher for a long period of time. Inflation in essence inflates away the debt. By making the purchasing power of the currency go lower through massive money printing or currency devaluations, inflation is created. Symptoms of this inflation can be a rise in consumer products and services as well as a rise in commodity prices.

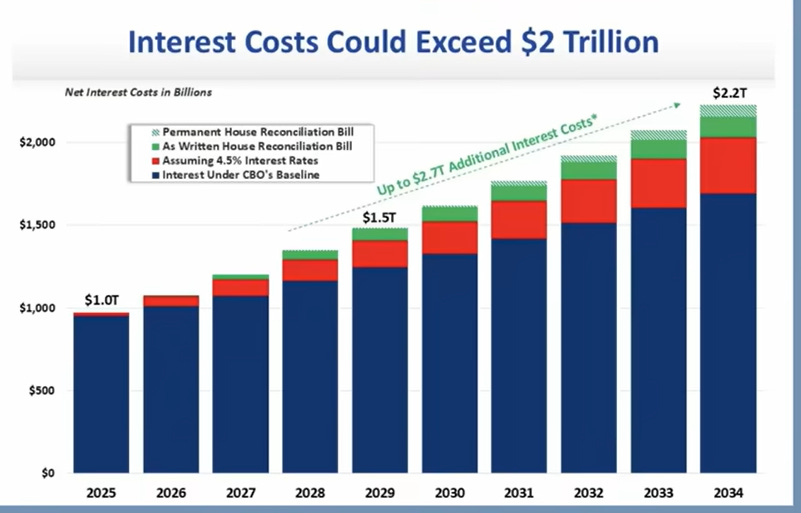

Given rising interest rates, which is likely to be a secular, long-term trend as we have pointed out in prior postings, the U.S. is having trouble servicing its massive government debt:

Triggering a Chain Reaction

Any one of the indebted G7 countries could trigger a chain reaction in currency devaluations as other countries will most likely follow suit with devaluations as well. Why? It is because all of these countries are inter-dependent with significant holdings of government debt held on other country debt instruments, causing a chain of devaluations. This has happened in Europe in 1967 and in Asia in 1997 with cascading devaluations.

Lena Petrova in her podcast channel and substack World Affairs in Context explains in more detail:

“The fallout will be global and it will be historic.” - Lena Petrova

From her substack, Lena explains:

“The early warning signs are flashing red. When investors lose faith in a government's ability to manage its finances, they begin to sell off sovereign bonds. That triggers a second, more dangerous wave: the selloff of the country’s currency. This is how currency collapses begin.

We've seen this before. France in the 1950s. The UK in the 1960s. Italy in the 1990s. Thailand, South Korea, and Indonesia during the 1997 Asian financial crisis. The difference now is scale—and interconnection.

The G-7 countries don’t just carry debt in their own currencies—they also hold reserves in each other's currencies. If one major economy starts to fall, the entire system feels the shock. This creates a dangerous feedback loop that could drag down multiple currencies at once, leading to a cascading global devaluation.”

Many of our Most Admired Advisors (MAAs) are warning of this currency collapse, advising holding of assets preserving purchasing power. Assets such as precious metals and limited token issuance-based cryptocurrencies.

How are we positioning our Portfolios to address this?

Become a paid subscriber today for access to the below, and to our entire postings, and to our model portfolios - for our best offer of less than $5 dollars a month.

Let’s view the detailed holdings in our portfolios. Our focus is on holding equities of great businesses around the world and on holding assets preserving the purchasing power of the portfolio as a whole …