Our Investment Strategy on China's Nuclear Energy Initiatives

A multi-faceted approach based on the Principles of Market Environmentalism and the Austrian School of Economics - we present our research and our investment holdings

In a previous posting, we highlighted the recent developments in nuclear energy development, both in nuclear fission and in nuclear fusion. Our most recent article in this space focuses on the rapid nuclear energy development in China, presenting leading solutions and initiatives especially in the technologies of thorium fuel-based molten-salt nuclear fission reactors.

Here we present our strategy on investing in the nuclear space, through our approach based on the principles of the Austrian School of Economics and on Market Environmentalism - emphasizing solutions that make sense financially, economically and environmentally.

We note four big trends in electricity demand trends currently and in the future:

The International Energy Agency projects that global demand for electricity will increase rapidly through 2025 and beyond, led by emerging economies such as China and India and powered by several trends including:

Artificial Intelligence: Advances in artificial intelligence and other data-heavy technologies are rapidly increasing the need for data centers and their associated power consumption.

Electric Vehicles: Electric vehicle ownership is on the rise, along with a range of battery-powered machinery, all requiring electricity for charging.

Cryptocurrency: The continued adoption of digital assets is adding to the world’s growing power demand.

Climate/Heatwaves: Intense heatwaves in many regions have contributed to this elevated electricity demand, straining local power grids.

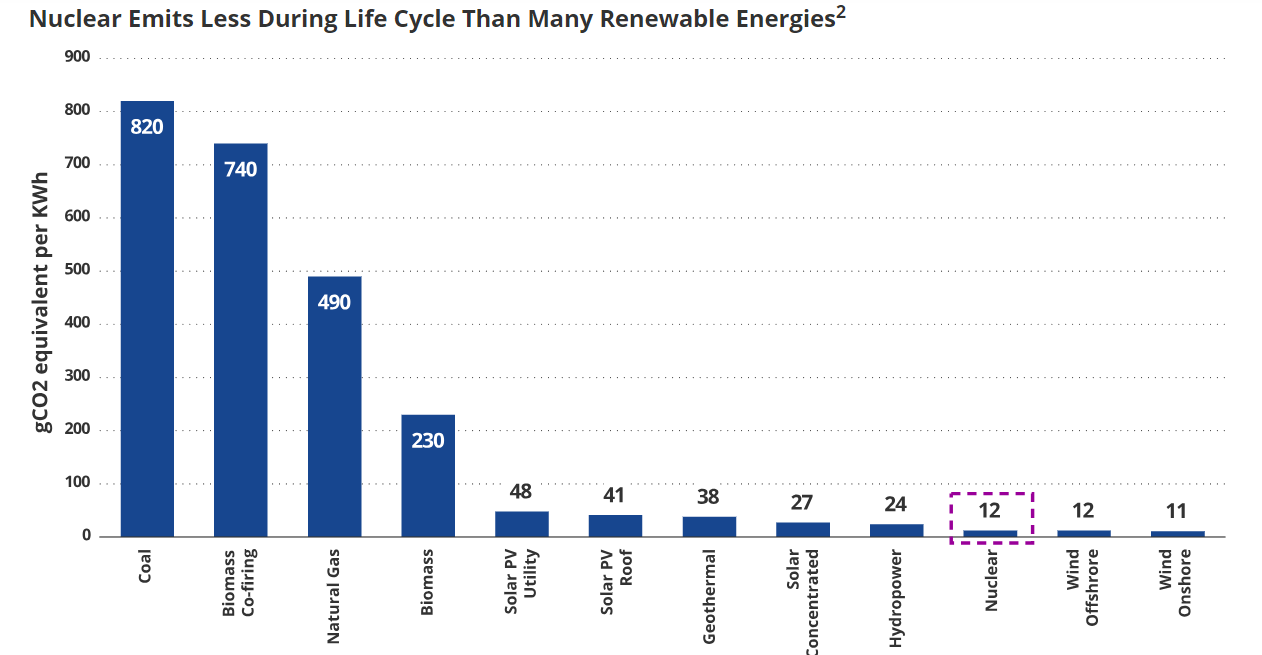

Nuclear energy is a clean, robust and scalable energy source that can help meet these four trends.

What is our investment strategy to invest in nuclear energy globally and in particular in the China initiatives into nuclear?

Let’s delve in …