Portfolio Outperformance Strategy Part 1: Cashflow is King

Cedar Owl Portfolio Outperformance Series Metric #1 Cash-Flowing Businesses correlating with Equity Portfolio Outperformance

We’re an economics and finance publication with a penchant for environmentalism featuring new releases every single week.

Over the coming several weeks, we will be exploring a seven part series on our strategy toward targeting portfolio outperformance. This is what gives the CedarOwl its competitive edge financially, in addition to its contribution to technologies that help save the environment.

This is the first article in a focus series to present the qualification metrics we look at in our actively management portfolio - The CedarOwl Portfolio. You can view the entire portfolio holdings along with our % weightings on a real-time ongoing basis by becoming a subscriber.

Our investment approach targets portfolio outperformance by assessing equities of great businesses from around the world which are not only successful financially and economically, but also are helping society and the environment at the same time.

Our investment approach assesses seven (7) quantitative factors that are based on our investment philosophy which leverages off the principles of the Austrian School of Economics (ASE) towards investing. Each of these seven factors have associated studies indicating a correlation with equity outperformance - therefore we look to qualifying equities of great businesses that can meet as many of these seven factors as possible, thus providing an additive probabilistic edge toward overall portfolio outperformance.

Each of these ASE value principles are based on the Austrian School of Economics - more info and videos here.

In other words, if we mathematically assess the equity outperformance correlation of metrics mapped to each of these ASE value principles, we then can leverage from an additive summation of the correlations together for even greater potential equity portfolio outperformance:

Additive Probabilistic Edge = P1 + P2 + P3 + P4 + P5 + P6 + P7

where Px = the probabilistic edge from the correlation of the first metric mapped to the correlation of equity outperformance of each of the above ASE value principles.

Today we look at a metric - Free Cash Flows, corresponding to the ASE value principle of “Value is placed upon high, positive cash-flowing businesses”.

There are many studies which demonstrate a strong correlation between businesses with free cash flows as a metric with their equity outperformance. Link here to one. Link here to another.

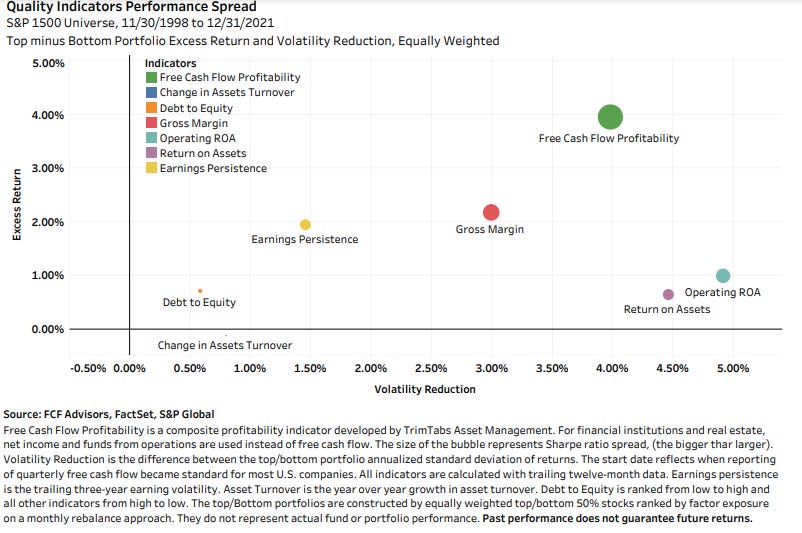

There is also a great study that was originally done through TrimTabs by Charles Biderman. The study has since been enhanced through FCF Funds by Vince Chen on January 2022. We can focus on the conclusions of this TrimTabs/FCF Funds study with the following conclusions and charts:

Superior Returns: Companies with strong Free Cash Flow Profitability has historically produced superior investment returns

Best Quality Indicator: There are many definitions for quality investing, but we believe Free Cash Flow is the key

Enhanced Fundamental Measures: Cash-based indicators outperform other fundamental indicators in different quality indicator groups

Sector Agnostic: The outperformance of Free Cash Flow is widely spread across different sectors

Downside Protection: A Focus on Free Cash Flow may provide a downside cushion during stressful market conditions

Global Alpha Opportunity: Free Cash Flow alpha may exist around the global equity market

Some of the supporting charts from the study:

Great positive free cash flows is just one of the factors we look at in our investment approach. In subsequent articles in our Focus Series on Portfolio Outperformance Targeting, we will explore the other six factors. Each of these other six factors also have associated studies indicating correlation with equity outperformance. So when you add up the outperformance probabilities together, the overall probability towards portfolio outperformance adds up.

Let’s view the current holdings and the current weightings in our CedarOwl Portfolio …