Gold vs. Bitcoin on Carbon Emissions, Environmental Impact & Store of Value

Comparing Gold & Bitcoin - Surprising & Interesting Results from a Variety of Perspectives & Data Points

We’re an economics and finance publication with a penchant for Market Environmentalism featuring new releases every single week.

Physical and digital mining, for gold or bitcoin, each come with their own unique environmental impacts - For what? Their value, that upholds fiat or cryptocurrency respectively. Today, from an environmentalist and Australian School of Economics perspective, let’s explore a direct comparison of gold and bitcoin on various factors including carbon emissions, environmental impact, and how well they serve as a store of value. We’ve pulled data from a broad set of sources and the results are quite surprising.

The results and implications are generally positive for both, but our analysis identifies a standout winner between the two. These factors have strong implications for the future of currency as we know it, so let’s dive into the data and analysis to discover who, gold or bitcoin, is the more sustainable, valuable play.

What’s In Today’s Article?

Comparison on Environmental Impact & Carbon Emissions

Store of Value

Correlation of Gold & Bitcoin to Equities on the Market

Conclusion

Environmental Impact and Carbon Emissions

The environmental ramifications of gold mining have left younger generations, including millennials, critical of the use of Gold as a store of value. Although sentiments are not unanimous on this solution, Bitcoin and other cryptocurrencies have stepped up to the plate to try to solve for the many issues faced by traditional fiat currencies. Until recently, especially in the last year, the environmental impacts of cryptocurrencies have been shrouded, allowing for a universal halo to enshroud cryptocurrencies like Bitcoin with an angelic aura. Yet, thanks to artificial intelligence hitting consumer acceptance through a free-ride mainline with tech like ChatGPT and MetaAI, the energy demands of AI and cryptocurrency could no longer be ignored. Processing power and data storage are quite ugly, tangible beasts after all.

Let’s explore the data and analysis on the environmental impacts of Gold and Bitcoin.

On Gold

A great article focusing on gold’s environmental impact highlights recent trends. There are now many companies which are focused with technologies and innovation which are making the gold mining industry clean and sustainable in ways which make sense financially, economically and environmentally. See below for an example company we like.

The gold mining industry is now a signatory to the Minamata Convention on Mercury, a global treaty to protect human health and the environment from the adverse effects of mercury. The convention entered into force in August 2017 and includes a ban on the use of mercury in new mines, and the phasing-out of mercury use in mines already in existence.

“Such moves appear to be working. In Ghana, which has recently overtaken South Africa as the continent's largest gold producer, some 40% of gold is sourced from artisanal and small-scale mines. Moreover, in November 2021, GhanaWeb reported that the Ghanaian government "has approved and procured a mercury-free mineral processing technology for small scale and community mining programmes to create sustainable jobs and protect the environment, the lives of miners, the communities and the entire citizenry".” - source link here

There is also now a current trend among ESG-conscious buyers on purchasing recycled gold, with some jewellers and high-end watch manufacturers focusing on this trend. This focus on recycling is very environmental friendly. Retailers like Mejuri (highly popular amongst Gen Z and Millennial buyers in North America) are participating in this trend.

Another trend is for gold investments to only have gold-related assets which meet special ESG standards. There are now Exchange Traded Funds (ETFs) which specialize in this. We’ll outline a great ETF example in the below section on equities.

Very interesting to note is how the World Gold Council has put out a number of great videos on gold as an ESG investment. Watch these below:

On Bitcoin

Regarding bitcoin as an ESG investment, there is a great article from CoinDesk and an industry study from KPMG.

“The mission of one U.S.-based company, Great American Mining, is to work within the oil and gas industry, helping producers that flare gas from oil wells to mine bitcoin and lower carbon emissions. That allows various energy companies to add revenue while improving their carbon footprint. Without tapping into that wasted energy, more emissions are unavoidable.” - CoinDesk

And on the benefit of social development:

“Bitcoin arguably offers the fairest and most equable form of money in human history. Some 70% of the citizens of El Salvador are unbanked according President Nayib Bukele, and yet most have a phone. Accordingly, they can use a mobile bitcoin wallet, which is now plugged into a worldwide monetary system.” - CoinDesk article

The KPMG study explains the benefits that bitcoin brings to governance, with the blockchain technology bringing “built-in” governance through the immutability of the technology.

Also in addition to the article and study, here are some positive considerations below. They emphasize the perspective of the trend of developing and using renewable energies for using in bitcoin mining. This can be seen as a driver of renewable energy development. Of course the development of renewable energy will help gold mining as well.

Getting Down To It: The Environmental Impact Comparison of Gold & Bitcoin

On comparing gold to bitcoin on environmental impact, the conclusions based on the above are:

Until renewable energies are developed on a larger scale, gold is near-term better than bitcoin with lower carbon emissions and a better environmental impact.

Bitcoin mining uses considerably more energy than gold mining - References: NY Times and Forbes.

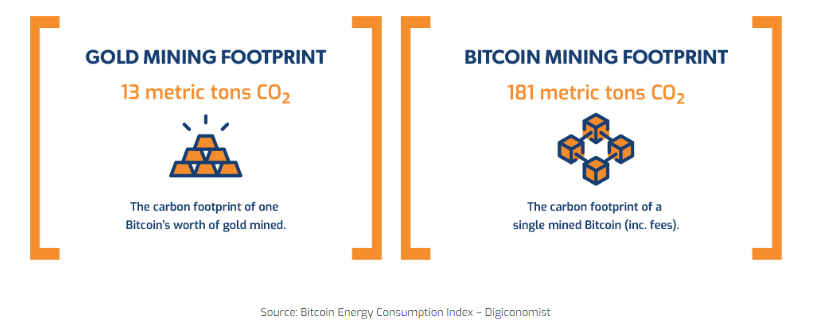

What About CO2 Emissions?

Here is a chart of the energy use and CO2 emissions by large bitcoin mines - Reference

Here is a great study on the environmental footprint of bitcoin (Reference). A great chart from that study confirms the above considerations on emphasizing the trend toward renewable energies would be positive for bitcoin, lowering carbon emissions:

Gold vs Bitcoin: Visualizing the Current Value:Carbon Emissions Comparison

Store of Value

Let’s compare gold and bitcoin on their efficiency as a store of value.

To do this let’s look at the numbers on costs versus value:

Bitcoin

July 29, 2024 - $69,239 per Bitcoin total cost of mining

Store of Value = $66,812 Value per Bitcoin / $69,239 Cost per Bitcoin = less than 1

Gold

July 29, 2024 - $1,342 per Ounce total cost of mining (reference here and here).

Store of Value = $2,427 Value per Gold ounce / $1,342 = about 1.8

Gold is currently now a better store of value compared to Bitcoin. Of course this may change depending on gold mining technology and energy usage trends versus bitcoin mining technology and energy usage trends, especially if bitcoin is mined using relatively lower cost renewable energy.

Another perspective on store of value is on assessing price volatility in general, and on assessing price behavior during period of risk-off time periods. Some observations on this perspective:

Price volatility - bitcoin is definitely more volatile than gold, which is overall negative for bitcoin as a store of value should preferably have stability in pricing.

Price during risk-off events - see the chart below which is a relative performance chart of the price of bitcoin in USD relative to the price of gold in USD, observe how during the last week from late Monday August 5, 2024 during the risk-off time period in the financial markets shows how gold is able to retain a store of value better than bitcoin:

It is important to realize when financial markets go from risk-on to risk-off, history shows that while gold may be sold initially along with the risk assets, it is generally due to margin calls on securities trading accounts - gold then generally recovers fairly quickly thereafter over the coming days as the risk-off process unfolds:

Correlation of Gold and Bitcoin to Equities

Another perspective on store of value comparison is looking at the correlation between gold and equities, and between bitcoin and equities. Generally over varying periods of time, gold tends to be inversely correlated to equities and bitcoin is generally correlated with, not inversely correlated to, risk asset equities.

Let’s look at the investment ideas we like in this space …