The Great Taking: How Could It Happen & What Can We Do to Slow The Momentum of Becoming At-Risk?

The Great Taking is the book by David Rogers Webb detailing the legal infrastructure in place now to legally confiscate many types of equities, bonds, cars and homes.

We’re a new economics and finance publication with a penchant for environmentalism featuring new releases every single week.

The World Economic Forum threw tact to the wind during the early Covid-19 Pandemic lockdowns with their announcement of ‘The Great Reset’, a distillation of eight world-power think tank ‘predictions’ - or warnings - we are meant to accept as inevitable change to the course of society - with one fabled sentiment that sewed particular distaste: “You will own nothing and be happy”. At a time when the masses were highly compromised, confused and anxious, this set a tone of distrust and doubt. In the time since this inflection point, we’ve seen a cascade of economic consequences of these lockdown measures, not to mention historic action, debt and natural shifts in economic dominance across categories. In this way, The Great Reset was the canary in the coal mine or Trojan horse leading the way to Neo-Caesarian proscription-like easy ceasing of private property, including land, equities and more.

Author David Rogers Webb calls this presently unfolding phenomenon “The Great Taking”, in his book under the same title. The book details potential legal scenarios that could come to pass, fulfilling the Reset’s “You will own nothing” suggestion.

In this article, we will explore the looming dark cloud of policy that could arise, their consequences and the current discourse on this “Chicken or Egg” scenario. At the end, you’ll be provided with our downloadable flow chart of possible risks involved and our positive ideas to mitigate the said risks of being “Taken”.

You can download the entire book ‘The Great Taking’ by David Roger’s Webb for free.

Content to Catch You Up

We recommend you add the below content to your podcast listening cue. First, a great podcast of David Rogers Webb together with Chris Martenson on Peak Prosperity - dated recently on April 18, 2024. Other podcasts below are also great to provide an overall understanding the what, why, and how there is an increasing potential for The Great Taking.

Uniform Commercial Code

In the United States, Uniform Commercial Code (UCC) is the legal document that covers this topic. Article 8 covers the scope. In particular the 500 series under Article 8.

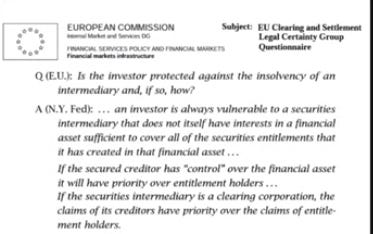

David points out how the bank lobbyists have been trying to spin this as “assuring protection” but in fact it is the opposite on properties relating to “secured creditors to intermediaries”. Creditors have a right to sell assets in a crisis event affecting the assets or properties. The “beneficial owner” does not have legal control over the asset or property. If the creditor is a clearing entity, that creditor always has priority. The wording in the legal document is written that does not give priority on property rights to the entitlement owners (meaning like the owner of a home, property, equity, bond etc.).

What’s this about? What are the risks to investments, properties and property rights?

The risk is that the biggest creditors (not even all big financial institutions) could own almost every asset or property from everyone. From bonds to equities to homes and to even cars.

The World Economic Forum (WEF) motto states: “You will own nothing and be happy” may materialize in the event of various serious debt-based scenarios or derivative-based escalations. These events are now increasing in likelihood due to the unsustainable levels of debt in the heavily indebted western world. Even a scenario where a homeowner has a mortgage and is faithfully making monthly payments to a bank which is running into some liquidity challenge - the bank may be forced to “call in the mortgage loan” together with a forced home sale. Oops, sorry!

The “be happy” result could materialize through “Universal Basic Income (UBI)” - for example, indebted homeowners with difficulty paying mortgages could have their homes bought out by the government, therefore owned by the government, but with the provision that the former homeowner is allowed to continue to live in the home by paying rent (from the UBI) back to the government as the owner of the home. The concept of UBI is becoming less a traditionally socialist issue and more so a necessity to offset the livelihood loss that is cresting today, picking up tsunami momentum as robotics and artificial intelligence replace human work, Sam Altman of Open AI warns.

The above video reviews the below bullet points:

Silver Linings

In the above podcasts, David highlights some great recent legal developments in South Dakota and Tennessee that represent some great local jurisdictions “wins” which will now force a more national U.S.-wide discussion on the UCC Article 8.

David mentions the simplest solution is the rewrite legal documents at a local jurisdictional level to ensure priority to entitlement/beneficial owners of assets and properties with no exceptions. But the legal infrastructure in many jurisdictions is still in place for The Great Taking to be legally executed for confiscating many types of equities, bonds, cars and homes. Are there any positive ideas to help mitigate the risks of The Great Taking? One of the positive ideas is to do a “DRS Transfer” to get direct ownership of a fully-paid (no debt) equity in the form of a physical stock certificate or online-based stock certificate - what is a “DRS Transfer” and how is a “DRS Transfer” done? Let’s jump in for a discussion on these positive ideas…