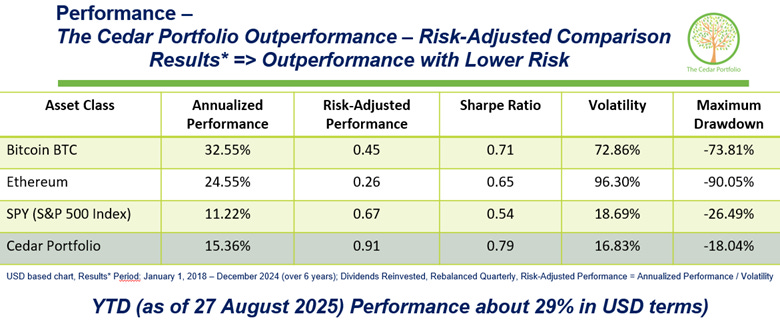

Update on our Global Cedar Portfolio which has no U.S. holdings and no EU holdings - up over 35% YTD in USD terms

Performance YTD

Our Global Cedar Portfolio is up 29.18% YTD as of September 22, 2025 in SGD terms. With the Singapore dollar appreciating relative to the USD this year by approximately 6% this translates to a performance of over 35% in USD terms YTD.

Global Cedar Portfolio: A Value-Driven Approach to Global Investing

Welcome to Cedar Portfolio, where we champion a value-driven investment philosophy designed to navigate the complexities of the global market. Our mission is to deliver outperformance at relatively lower risk, achieved through a disciplined and research-intensive process. We focus on identifying and investing in great businesses from around the world, alongside assets that preserve purchasing power. This approach allows us to build a resilient and diversified portfolio that stands the test of time.

At Cedar Portfolio, we believe that a successful investment strategy is built on a foundation of People, Product, Performance, and Process. Our team of experienced professionals, our innovative investment products, our proven performance, and our rigorous investment process all work in concert to deliver exceptional results for our clients. We are committed to transparency in our investment strategy.

Performance: Outperformance with Lower Risk

Our track record demonstrates the effectiveness of our investment strategy. We have consistently outperformed major market benchmarks on a risk-adjusted basis, delivering superior returns with lower volatility. The Cedar Portfolio has shown resilience in various market conditions, a testament to our disciplined approach and focus on quality.

The People Behind Cedar Portfolio

Our team is the cornerstone of our success. We have assembled a group of seasoned professionals with diverse backgrounds and deep expertise in finance, economics, and technology. Our leadership team is dedicated to a culture of intellectual curiosity, rigorous analysis, and a shared commitment to our clients’ success.

Our Investment Strategy

We offer an actively managed, value-investing investment strategy focused on equities of great businesses from around the world, and assets preserving purchasing power. Our goal is to target outperformance at relatively lower risk:

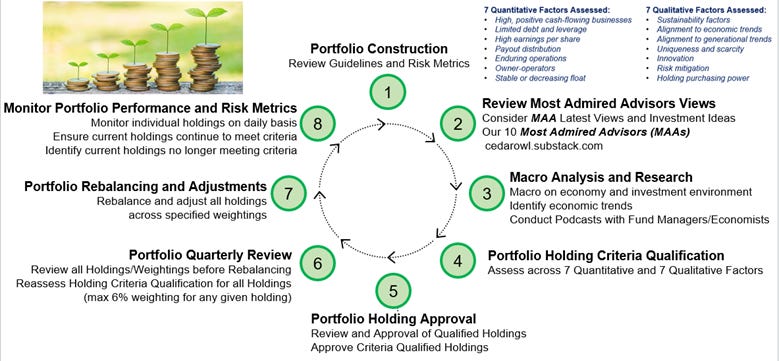

Our Process: A Disciplined and Rigorous Approach

Our investment process is a systematic and disciplined framework that guides our portfolio construction and risk management. It is a continuous cycle of research, analysis, and review that ensures our portfolio is always aligned with our investment philosophy and our clients’ objectives. This disciplined process, combined with the expertise of our team, allows us to build a portfolio that is well-positioned to deliver long-term outperformance.

• Website:

https://cedarportfolio.com

• Email: info@cedarportfolio.com

Disclaimer:

This information and material contained in this brochure is of a general nature and is intended for educational purposes only. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. This presentation does not constitute a recommendation or a solicitation or offer of the purchase or sale of securities. Furthermore, this presentation does not endorse or recommend any tax, legal, or investment related strategy, trading related strategy or model portfolio. The future performance of an investment, trade, strategy or model portfolio cannot be deduced from past performance.

As with any investment, trade, strategy or mode portfolio, the outcome depends upon many factors including: investment or trading objectives, income, net worth, tax bracket, risk tolerance, as well as economic and market factors. Asset allocation does not assure or guarantee better performance and cannot eliminate the risk of investment or trading loss. Economic forecasts set forth may not develop as predicted and there can be no guarantee that investments, trades, strategies or mode portfolios promoted will be successful.

All information contained in this presentation has been derived from sources that are deemed to be reliable but not guaranteed.

Partner Together?

If you are interested in partnering together to use our investment strategy and actively managed portfolio to offer an ETF, UCITS or other type of fund including tokenized forms of a fund such as an on-chain tokenized portfolio fund, please contact us at info@cedarportfolio.com.

View all our Portfolios

Become a paid subscriber today for access to the below, and to our entire postings, and to our model portfolios - for our best offer of less than $5 dollars a month.