Are the U.S. tariffs an attempt to isolate China? What are the implications of the tariffs to the Global Economy and the Investment Environment?

Singapore Prime Minister: "This is the end of the U.S. as the bedrock for the free market economies of the world"

Amidst the growing pressures of unsustainable government debt, along with diminishing demand for the bonds of its debt, the U.S. believes that a manufacturing renaissance in the U.S. will help to address its massive debt, deficits and trade imbalance challenges. Will it work? Let’s delve in to explore.

What are the U.S. Tariffs and How were they calculated?

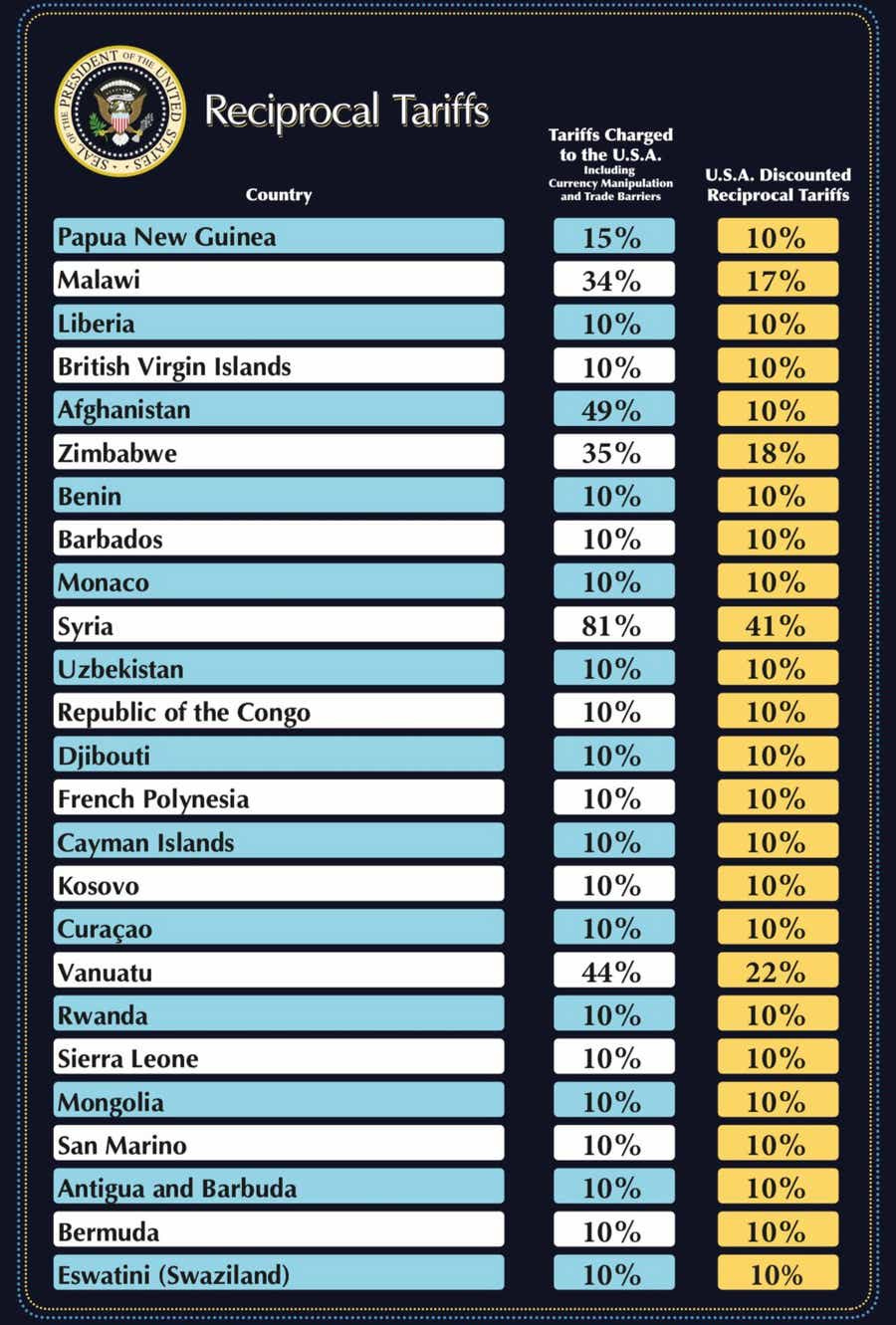

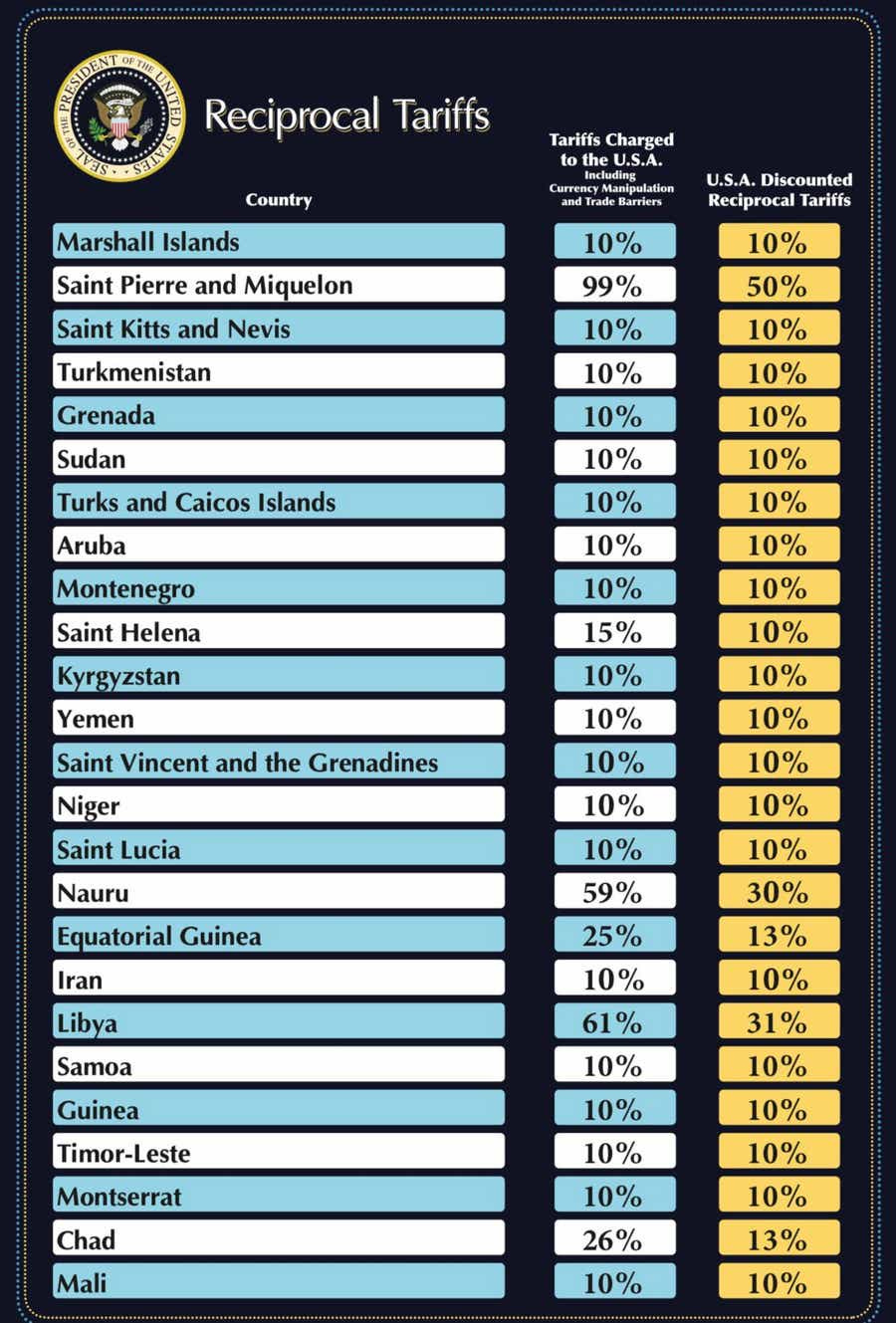

Here is the complete list of the U.S. Tariffs ordered by U.S. President Donald Trump:

The “10%” numbers represent the lowest “default” level, even though many of these countries levy 0% tariff rates.

Watch this video podcast by Bret Weinstein on the tariffs. It explains how the tariffs are calculated - very simply the trade balance with a country is divided by the imports from that country and the overall this number is divided by 2 (supposedly as a gesture of goodwill by the U.S. in being half as harsh as they feel they should be), or 10% whichever is higher. You end up with this chart - which grossly simplifies trade and unfairly punishes smaller, low-income countries like Madagascar which exports agricultural products to the U.S. but is unable to afford buying relatively expensive products and services from the U.S.:

AEI explains why the U.S. calculation for “reciprocal tariffs” does not make sense, is erroneous and is based on a flawed economics - link here:

“Correcting the Trump Administration’s error would reduce the tariffs assumed to be applied by each country to the United States to about a fourth of their stated level, and as a result, cut the tariffs announced by President Trump on Wednesday by the same fraction, subject to the 10 percent tariff floor.”

Our Initial Thoughts on the Tariffs

Here are our initial thoughts on the tariffs, though the situation is dynamic and changing on a daily basis as the U.S. Administration issues Executive Orders on a daily basis now:

On Wednesday April 9th, U.S. President Donald Trump has paused the tariff full implementation date by 90 days. All countries except China will have tariffs during this 90 day period reduced to 10%. China’s tariff is now at 125%, as it has escalated from the initial 34% set as per the above proclamation.

We see the 10% being levied even on countries which had no tariffs before - many countries were at 0% before. These countries are not happy with this arrangement. We think the reason is that the U.S. is worried that these countries could be used by China in exporting China-made products through these countries instead of from higher-tariffed China.

U.S. economic policy goals and the U.S. tariff goals seem to be trying to meet several inconsistent goals - reducing the trade deficit, keeping the U.S. Dollar as the global reserve currency, weakening the value of the U.S. Dollar, reshoring jobs back to the U.S., launching a manufacturing revival in the U.S., and above all trying to isolate China from the rest of the world in terms of trade and relations. Tariffs and reducing the trade deficit have the effect of strengthening the U.S. Dollar not weakening it. Reducing the trade deficit makes it more challenging to maintain the U.S. Dollar as the global reserve currency (see below for more insights on this). 0% tariffs through negotiated deals would tend to increase the imbalance of trade, not reduce the trade deficit.

We think the biggest goal of the U.S. on the tariffs is an attempt to isolate China from the rest of the world in terms of trade and relations. It is likely that in all the tariff negotiations with another country (other than China), the U.S. will attempt to not only negotiate for 0% tariffs but also require the country to stop or severely restrict trade and/or relations with China - this is already happening on negotiations with Vietnam as even though they are offering 0% tariffs to the U.S., the U.S. is rejecting this offer unless Vietnam agrees to severe restrictions on trade flows with China. We think this “negative” approach will eventually backfire, with countries accelerating their de-dollarization and trade away from the U.S..

Let’s explore what others have to say on the tariffs …

Thoughts on the Tariffs from the Singapore Prime Minister

The Singapore Prime Minister went viral on social media with the below video message. He emphasizes:

U.S. is abandoning the international trade agreements and trading system.

Likelihood of a full-blown global trade war is growing.

International trade and investments will suffer.

Global trade will slow.

Diversification on trade should now be fostered with “like-minded” countries.

Thoughts on the Tariffs from Economist Peter Boockvar

“1)There is a flawed premise that trade deficits are bad and that the country that has the surplus is somehow ripping us off. Walmart has a trade deficit with China and somehow it's been tremendously advantageous to both sides for decades and US consumers have benefited by providing low cost options of essential items many need to buy each day/week/month/year with their paychecks.

2)I have a trade deficit with the restaurant I went to last night but I got a great meal and the restaurant made money. We both benefited. For those that we have a services surplus with, the whole world in aggregate, I don't believe we're ripping them off as no one is forcing them to travel here.

3)Bringing more US manufacturing jobs back to the US and creating more opportunity here is very laudable but tariffs are a dangerous tool because of the huge amount of intermediate goods that get negatively hit from the tariffs.

4)The assumption that tariffs are the proper tool to encourage reshoring is on shaky ground if we just look back to 2018 where not much has occurred since. And, the steel and aluminum tariffs back then did more damage to the users of steel and aluminum than it did to benefit the steel and aluminum producers.

5)We also risk losing manufacturing jobs from those US producers that export as they might shift manufacturing facilities from the US to countries where they do business with in order to better compete and hedge against the rising cost of doing business in the US.

6)In fact, US manufacturing went into a recession in 2018/2019 after that tariff battle and which resulted in the Federal Reserve cutting interest rates in 2019.

7)By putting up walls around the US to encourage domestic manufacturing assumes that US consumers will be able to afford what is produced. It also assumes that the US would be able to be cost competitive with the rest of the world with regards to exporting what is made here. Tariffs will make both more unlikely.

8)Yes, if the end result is a global lowering of tariffs, as I agree that some (not all as being implied) are not fair with us, than we all benefit but there is one thing to do a deal that only impacts the negotiator and the party being negotiated with, the consequences are experienced by just these two parties. Currently, the 'deal' negotiations is impacting all of us, particularly small and medium sized businesses, many of which that are now in a panic with fingers crossed that somehow this all works out.

9)But is the real goal to lower global tariffs? It seems instead (in addition to wanting to reshore) being used as a way to raise money, as it will 'make us all rich'. Even though US importers actually pay the tariff, thus making them poor, but with hopes that either thru a stronger US$ (not happening now), discounted products by the exporter, and/or raising prices to the rest of us, the US importer will somehow recapture the tax paid. Maybe, maybe not.

10)For those users of steel and aluminum, the 2018 tariffs only raised their costs and jobs were lost as a result.

11)Relying on lower corporate tax rates, deregulation and permitting relief could have been a much more effective way of lowering our cost base to encourage more domestic production as well as via better education/training/re-training.”

Thoughts on the Tariffs from Economist Thomas Sowell

"When you set off a trade war, like any other war, you have no idea how that's going to end.…You do not make America great again by raising the price to Americans, which is what a tariff does." - source link here

Thoughts on the Tariffs from Trader Ferg

From Trader Ferg’s recent substack article inflationary aspects:

Tariffs are highly inflationary, and the idea that they'll just cause a temporary bump in inflation is ridiculous. $300B of the U.S. trade deficit is literally capital goods i.e. all the stuff you need to make stuff/reshore manufacturing, which had long lead times prior to announced tariffs. Take these two examples:

(Feb 2025) “If you’re building a project that involves a gas turbine, the largest manufacturers say you should be talking to your OEMs as long as seven or eight years out.”

(Dec 2024)“The demand for transformers has spiked worldwide, and so the wait time to get a new transformer has doubled from 50 weeks in 2021 to nearly two years now.”

Perhaps the Best Analysis ofthe Tariffs

Here is perhaps the best analysis of the tariffs, explained in easy-to-understand terms along with the implications. A podcast with Australian Professor Warwick Powell. He explains the following points:

U.S. is effectively ending its own hegemony with the U.S. Dollar as the world’s reserve currency status. With a target mandate of reshoring and revitalizing U.S. manufacturing back to the U.S., this will result in a lower trade deficit towards 0 or even positive instead of negative. A negative trade deficit is required by the world’s reserve currency status - see Triffin’s Dilemma.

Globalization will likely intensify between non-U.S. countries as in the Global South due to de-dollarization and the movement of trade away from the U.S..

China trade will intensify with non-U.S. countries, especially for agricultural and energy commodities, and will serve as a cushion of the burden of U.S. tariffs on other countries.

Trade agreements in areas like South East Asia and now between China, South Korea and Japan will intensify with member countries.

Even if the Trump tariffs force or encourage companies to relocate or setup manufacturing plants in the U.S., there are extensive “intermediate” supplies needed in the manufacturing process as inputs, and these “intermediate” supplies may need to be expensively sourced from heavily-tariffed countries or may need to be made more expensively in the U.S. with higher labor rates.

The U.S. will require a significant amount of time to enhance the energy and telecommunications infrastructure to be able to meet the requirements of the manufacturing renaissance. This will take a lot of time and money.

The U.S. will require to enhance the skills and education of its people to be able to meet the requirements of the manufacturing renaissance. Again this will take a lot of time and money.

All of the above factors taken into consideration mean increasingly costly products and services, whether made in the U.S., whether sources from abroad or whether purchased with the tariffs - spelling rising inflation.

One point not mentioned by Professor Powell are the legal and regulatory challenges. In the U.S., there are so many laws and regulations restricting or prohibiting parts or many aspects of manufacturing processes, including those with environmental impacts, which make it very expensive or even prohibitive to address. In some cases, these legal and regulatory challenges could take years to resolve.

Also another important point is if it is the case that these tariffs are so-called “negotiating tools” for better trade agreements, in some cases even to the point of 0% tariffs reciprocally - in this regard, the concept of using the tariffs as negotiating tools make trade with those countries easier and lower cost, thereby continuing and even growing that trade with those countries, exacerbating the U.S. trade deficit even further and prohibiting the target goal of a U.S. manufacturing renaissance. Is the mandate to re-shore and bring back manufacturing to reduce the trade deficit, or to use the tariffs as “negotiating tools” to effectively increase the trade deficit even more through better trade deals at 0% or lower tariff rates?

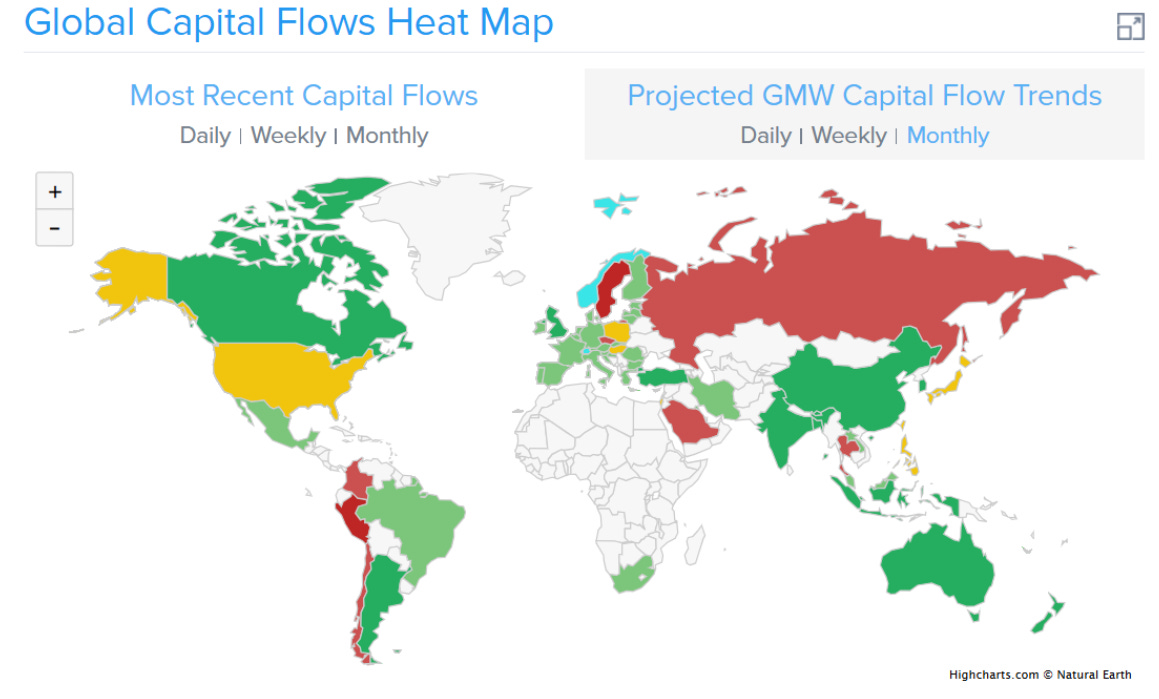

Implications on International Capital Flows

We just wrote a substack article a couple weeks ago in which we provided a chart on the projected monthly capital flows in the near future. The chart indicates how the U.S. is at a major high or major low, and we provide considerations which we feel indicate that the U.S. is at a major high, meaning capital will move away from the U.S. to other countries.

What are International Capital Flows Indicating?

Where are investment assets flowing to? From which countries to which countries? How will these flows be affected in the event of escalating wars, such as in Europe involving Ukraine and Russia, or in the Middle East involving Israel and Iran?

Here is the International Capital Flows Map, courtesy of Armstrong Economics - link here to find more about their services.

Positive Ideas

The U.S. appears to be realizing that China has leapfrogged the U.S. in all industries over the past several years, as we have observed in prior posts. Especially over the past few years in which the G7 has been focused more on social issues, gender studies, DEI and uneconomical ESG initiatives, at a time when China has been focused more on engineering studies, innovation, opportunities for all and on economical ESG initiatives.

As such, instead of draconian measure, financial engineering, increasing debt and levying insane tariffs, the following program for the U.S. would make more sense and address the challenges directly:

Promoting and fostering the education and training landscape: a focus on engineering, computer science, AI, and innovation in education and universities.

Setting up a work visa program to attract foreign, educated and experienced talent towards work and investment into the U.S..

Leverage existing talent in the financial sector towards the manufacturing and industrial sectors through private-based programs and corporate initiatives.

Develop globally competitive industries through high quality products and services which garner demand internationally.

Restructuring and optimizing the regulatory landscape: removing obsolete and duplicate regulations, optimizing existing needed regulations, prohibiting regulatory capture-based regulations, and facilitating regulations towards increased innovation, entrepreneurialism and industrial development.

Restructuring unsustainable government debt through equity-based initiatives, and privatization of government land and property sales.

Migrate towards increasing direct democracy and away from representative democracy. Minimize entanglements in foreign affairs of other countries, and promote leadership through economic development and social discourse.

Foster free trade agreements with all countries of the world, leveraging and optimizing local talents, specializations and expertise towards improving economic conditions and standards of living.

How We are Investing in this Environment

Let’s delve in how we are investing in this environment …