What are International Capital Flows Indicating?

Which Countries are Investment Assets flowing to?

Where are investment assets flowing to? From which countries to which countries? How will these flows be affected in the event of escalating wars, such as in Europe involving Ukraine and Russia, or in the Middle East involving Israel and Iran?

These are interesting questions which we attempt here to look at. We need to consider global political uncertainties into our analysis - for this we are launching a new set of services focusing on geo-political services, how geo-political risks affect the economy, trade and investments, and what changes or mitigations can be instituted to help address these risks and challenges - suggest watching our upcoming podcast between industry veterans Yra Harris and Art Berman on Global Political Uncertainties - A Risk Management Process to Help Address Risks to Investments and to Business on April 30th at 1130am ET, you can request to join in the podcast ahead of time to be able to ask a question to Yra and Art - link here to request to join our podcast directly in the podcast room.

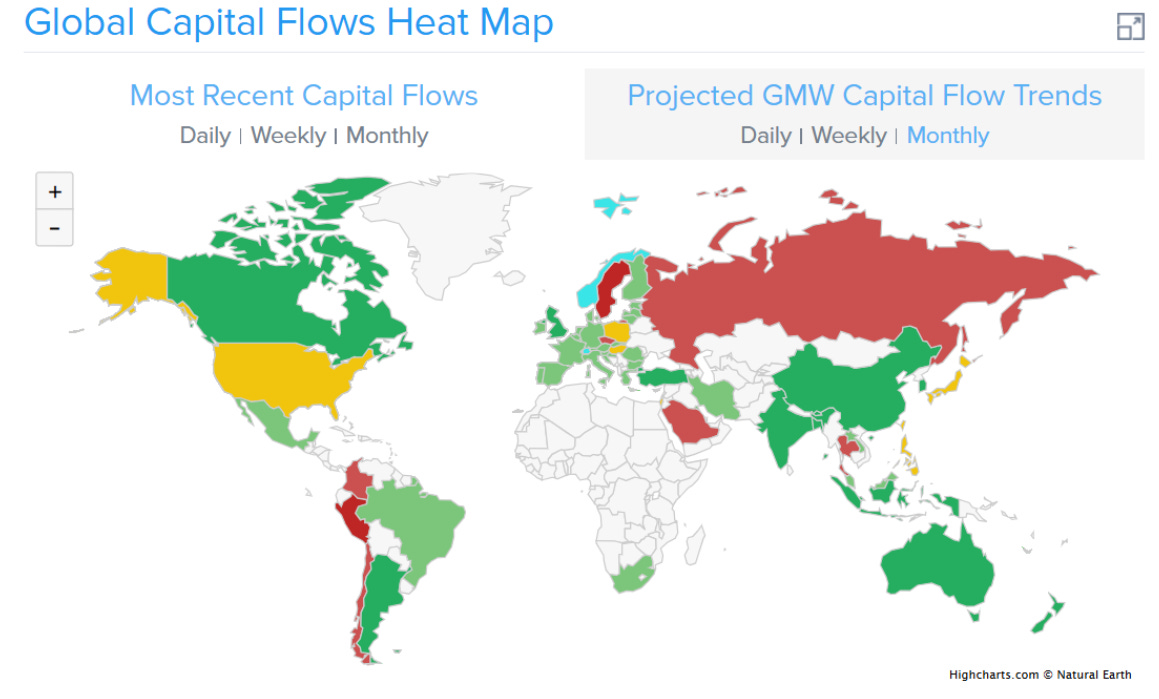

International Capital Flows Map

Here is the International Capital Flows Map, courtesy of Armstrong Economics - link here to find more about their services.

This is a projection of the coming near-term capital flows from a monthly indicator perspective. What can be discerned from the projection-focused diagram?

Here are our thoughts: Bullish flows appear to be going to Argentina, Brazil, Indonesia, Malaysia, China, India, Australia and New Zealand as well as a few other areas. It is important to realize these capital flows are dynamic and can change quickly depending on a variety of factors.

Interestingly the United States is projecting a high or a low. Our interpretation of this is that it is likely a high, given the fact that approximately over 60% of all global investable assets are in the U.S. financial markets, with a heavy concentration risk of recently as high as 30% into the big tech stocks like Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla (forming the Magnificent 7), meaning as recently as high as 18% of all global investment assets into the Magnificent 7, even though the U.S. share of global population is only 4% and the U.S. share of global GDP is only about 20%. And in recent weeks we have see the beginning of a selloff in the Magnificent 7.

So capital flows appear to be coming out of the U.S. and going to a number of countries, listed per the above. We see this as a global re-allocation of capital, and we believe that this trend will continue in the event of escalating wars. In the past, during times of escalating wars, capital mostly gravitated toward the United States. However, given global political uncertainties stemming from concerns and trends involving U.S.-instituted tariffs, G7 freezing/confiscation of non-G7 country and even non-G7 citizens, and unsustainable high levels of G7 debt driving inflation-resulting policies, we believe that the international capital flows during the current and escalating wars will likely drive international capital to the countries depicted in the capital flows diagram above, and not likely to the United States.

Fundamental Analysis Considerations Supporting the Monthly International Capital Flows Diagram

Several of our Most Admired Advisors (MAA) such as Dr. Marc Faber and Louis-Vincent Gave, have been highlighting the great opportunities in the countries listed above. In addition to these MAAs, former Goldman Sachs Managing Director and financial expert Nomi Prins has written an awesome insightful substack article, similarly highlighting the opportunities in international markets through fundamental analysis-based considerations:

Some insightful quotes from Nomi:

China's Resurgence: After a period of financial recalibration, China's economy is showing signs of renewed strength. While material challenges remain, the sheer size and growth potential of the Chinese market should not be ignored.

The Untapped Potential of Emerging Markets: Beyond China, the broader emerging market landscape offers a variety of opportunities .. Countries in Southeast Asia and Latin America are experiencing significant economic development and could offer strategic investments.

The United Kingdom: A Value Proposition with Global Reach: Many UK-listed companies are multinational corporations with significant global revenue streams, making them less reliant on the domestic UK economy. The relatively lower valuation of UK equities compared to their U.S. counterparts, coupled with attractive dividend yields, makes the UK an interesting market to consider.

Japan: A Sleeping Giant Awakening? The Tokyo Stock Exchange offers exposure to leading companies in sectors like automobiles and tech, that are currently immune to tariffs.

Australia: Riding the Commodity Wave and Regional Stability: Its strong trading relationships with Asia, particularly China, also give it a diversified trading group. This makes Australia a potential beneficiary of global demand for commodities. Australia's relatively stable political and economic environment, coupled with its geographic distance from major geopolitical hotspots, provides a great degree of insulation.

Check out our recent article on a Dividend Gem in a World of Volatility with a public listing in the major exchange in the UK.

Disclaimer: This information and material contained in this post is of a general nature and is intended for educational purposes only. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. This post does not constitute a recommendation or a solicitation or offer of the purchase or sale of securities. Furthermore, this post does not endorse or recommend any tax, legal, or investment related strategy, trading related strategy or model portfolio. The future performance of an investment, trade, strategy or model portfolio cannot be deduced from past performance. As with any investment, trade, strategy or model portfolio, the outcome depends upon many factors including: investment or trading objectives, income, net worth, tax bracket, suitability, risk tolerance, as well as economic and market factors. Economic forecasts set forth may not develop as predicted and there can be no guarantee that investments, trades, strategies or model portfolios will be successful. All information contained in this post has been derived from sources that are deemed to be reliable but not guaranteed.

wenotmefarms.org Would you check out the webpage, paying attention to the Trust prespectus, and consider taking a position, plus promoting our mission so others can take a position? We would like to collaborate with you.