We’re an economics and finance publication with a penchant for Market Environmentalism featuring new releases every single week.

Introduction

Welcome to the second half of our 2-Part Hydrogen Energy Series. Last month, we covered the basics of hydrogen energy as a fuel source, including its projected role in the global energy value chain or ecosystem, its strengths, weaknesses, opportunities and threats. If you missed it, you can catch up on part 1 here. Available entirely to the public, bookmark it as your go-to resource on the essentials of hydrogen energy and the role it will play in our new energy distribution by 2050.

This week, we’re diving into some cutting edge projects that will make the highlights of hydrogen energy a reality in the near and far future.

What’s In Today’s Article?

Fun Facts on Hydrogen

Key Projects in Aviation and Shipping

Equities We Like and Their Company’s Hydrogen Energy Projects

Fun Facts on Hydrogen

Hydrogen energy is a secondary fuel source. Its non-renewable nature has strengths and weaknesses that will ultimately define its identity by 2050. David Burns at Linde calls hydrogen the solution to ‘hard to abate’ industries. Hydrogen fuel can be used where traditional burning of fossil fuels would have otherwise remained a choice solution, all factors considered. Along the transition to hydrogen’s projected 12% global energy contribution, hydrogen can be incorporated into a natural gas-hydrogen fuel blend of up to 10-12% today without needing to make modifications to burners.

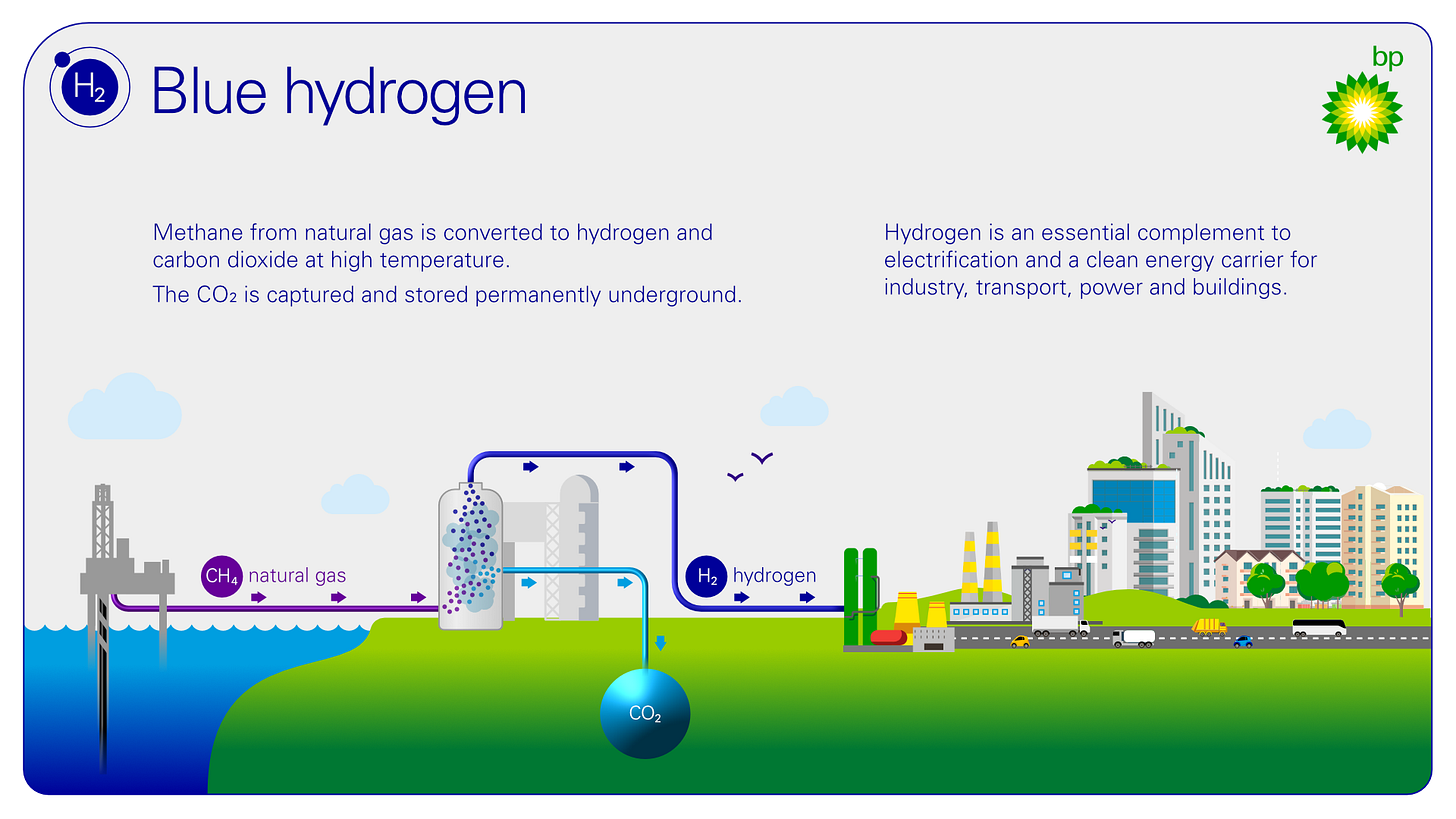

Currently, the largest opportunity for hydrogen energy is in ‘blue hydrogen’, which is grey hydrogen treated with carbon capture technology to mitigate its impact. In the short term, this will likely be the dominant means of production, while key technology innovators work on hydrogen electrolysis that will likely provide truly green and clean production. Once electrolysis is more mainstream, hydrogen can be produced via small generators for hyper-local needs, eventually solving for a portion of the distribution problem. Experts in the industry believe that pipelines and custom marine ships will be the solution to long-distance transportation of cryogenically liquefied hydrogen produced in large, scalable amounts.

Hydrogen is an industry with 100 years of history, and a key player that will be mentioned in our equities section even used to produce and supply hydrogen fuel to NASA in the 1960s.

Key Projects in Aviation, The Energy Grid and Shipping

Aviation

Airbus

Airbus is an engineering company that is rapidly growing. They’re heavy promoters of SAF, or sustainable aviation fuel including what they call eFuels, including hydrogen. They also believe in the future of electrified flight. They are still honestly discovering the true role and effect that hydrogen will have as a zero-carbon integration, but here’s what they claim so far:

“At Airbus, we see two primary uses for hydrogen:

Hydrogen propulsion: Hydrogen can be combusted through modified gas-turbine engines or converted into electrical power that complements the gas turbine via fuel cells. The combination of both creates a highly efficient hybrid-electric propulsion chain powered entirely by hydrogen.

Synthetic fuels: Hydrogen can be used to create e-fuels, which are generated exclusively through renewable energy.

We expect to make the necessary decisions on the best combination of hydrogen technologies by 2025.”

Source: “Hydrogen: An Important Decarbonization Pathway” Airbus.com

Airbus is an important player because they’re performing key research and development that will impact the entire hydrogen industry as well as the future energy economy at large.

Marine Transport aka Shipping

Hydrogen fuel cells are indicated for shipping as outlined in part 1 of our hydrogen series.

“A key advantage of hydrogen over other fuel alternatives is the relative ease of retrofitting existing ships with hydrogen fuel cells. (See Q3 for a more complete discussion of its advantages.) Hydrogen fuel could replace 43 percent of voyages between the United States and China without any changes, and 99 percent of voyages with minor changes to fuel capacity or operations.”

Source: “Hydrogen: The Key to Decarbonizing the Global Shipping Industry?” CSIS.com

ABB recently struck a partnership with Samskip Shipping to provide power to their shipping fleet.

“ABB will deliver a comprehensive power distribution system for two newbuild short-sea container ships of the global logistics company Samskip Group headquartered in Rotterdam, Netherlands. The vessels will be among the world’s first of their kind to use hydrogen as a fuel. Financial details were not disclosed. The order was booked in the second quarter of 2023.

Built by Cochin Shipyard Ltd, the largest shipbuilding and maintenance facility in India, the 135-meter ships are due for delivery in Q3 and Q4 of 2025, respectively. Both vessels will be operating between Oslo Fjord and Rotterdam, a distance of approximately 700 nautical miles.

In addition to the integration of hydrogen fuel cells, ABB’s comprehensive package includes the new, compact version of ABB Onboard DC Grid™ power distribution system that will ensure the optimal use of energy on board. The vessels will also feature ABB’s energy storage solution control, with the industry-leading automation technology, ABB Ability™ System 800xA, ensuring seamless operation of onboard equipment. Leveraging ABB Ability™ Remote Diagnostic Systems, the vessels will benefit from optimized safety and performance through 24/7 remote support.”

Source: link here

Now let’s dive into a portfolio of equities we like and a look at each player’s involvement in the role of building out Hydrogen Energy’s role in the energy supply chain of the future: