Will China Come out as a Winner in this Trade War, and If so, how?

Research Information Article by Art Berman, Yra Harris and the CedarOwl Team, and what we are considering in our portfolios

By Art Berman, Yra Harris and the CedarOwl Team

The trade war between the United States and China is intensifying. Who will win this war and how? Let’s take a scenario-based approach to this question and for each scenario, let’s suggest what we see are the actionable ideas from an investment perspective.

After years of escalating tariffs and tech restrictions, the U.S.-China trade war has become a protracted standoff. Under a renewed Trump Presidency, the conflict is intensifying. With tariffs initially reaching up to 145% on Chinese goods and retaliation from Beijing climbing to 125%, and now in a cool-off period of 115% less on both sides, both economies are now absorbing and planning for the resulting effects and associated damage.

Yet the central question remains: Could China emerge stronger from this contest? To answer that, we lay out three scenarios (S1, S2, S3) and assess China's potential trajectory.

Scenario S1 – U.S. wins U.S. successfully isolates and outcompetes China (Bear case for China)

Assumptions: Trump tightens capital controls and tech bans; U.S. allies coordinate on China decoupling; Chinese domestic consumption stalls. Regulations and permitting required for building and operating more manufacturing plants is facilitated to help reshoring and development.

For the U.S. to win, these factors will need to align and be addressed:

o An educated and trained workforce with enhanced and competitive skills in industry, engineering and manufacturing – this may take some time to foster as much of the trained resources in industry and manufacturing, especially in the U.S. heartland mid-west, have re-trained over the past several decades into health care and financial services sectors.

o A focus and emphasis on innovation and competitiveness – the U.S. is traditionally a global leader in this regard given its culture is very suited and aligned with these values and approach. However, innovation will require the enhancement in education and training mentioned above. And tariffs may help create an industrial and manufacturing economy in the short term but will shelter the industries from global competitiveness as tariffs retard innovation and competitiveness.

o A regulatory environment and legal framework which foster investment and business development, and which allow industrial and manufacturing development – this is going to take a lot of legal and government administrative work, given that there will be a lot of legal battles, especially where regulatory capture is involved and where governments require many permits and changes to existing legislation to allow manufacturing plants to be build. Just this week the U.S. Trade Courts strikes down Trump’s Global Tariffs Plan.

S1 - Actionable Ideas we are considering in our portfolios:

· Overweight U.S. defense, energy, and tech stocks, especially those aligned with national security mandates.

· Shift Emerging Market (EM) exposure to non-China players (e.g., India, Mexico, Poland).

· Reduce or eliminate Chinese ADRs and ETFs, especially in tech and consumer discretionary.

· Buy U.S. Treasuries and gold as volatility and risk premia rise.

· Long Copper for electrification enhancement required for industrial and manufacturing development – Copper as a commodity and we like firms like SCCO, VALE, BHP, RIO. Last week the U.S. Supreme Court decided in favor of the Resolution Copper mine in its case against the Apache and other tribes trying to prevent the beginning of copper mining in a deal controlled by BHP and RIO Tinto in the largest copper mine in the U.S. - while it will take a while to get production flowing, it may be accretive to BHP and RIO.

· Buy Industrial firms, we like ABB, CAT, SLB, and firms implementing AI engineered solutions.

Scenario S2 – Stalemate or partial win (base case)

Assumptions: Tariffs persist; supply chains reconfigure partially and especially in critical minerals required for industry and manufacturing – see below; both economies slow but remain stable; tech bifurcation accelerates.

In this scenario, these considerations and trends are pertinent:

o China since 2018 has focused less on property development and more on industrial development – see chart below courtesy of Gavekal (source link); associated with this move was a diversification of trade and supply chains away from the U.S. – all being driven by the U.S. ban of semiconductor technology in 2018 (link here).

o China has now leapfrogged the U.S. in virtually all industries – more globally competitive – listen to this podcast on how this is happening - Gavekal analyst Louis-Vincent Gave.

o China less dependent on its GDP versus U.S. more dependent on China imports for not only retail but also intermediate goods needed in industry and manufacturing. See chart courtesy of Economist Sean Foo:

o De-dollarization and trade away from U.S. are accelerating – China RMB-based CIPS system versus SWIFT indicate the use of China’s payment system is growing fast. In addition, China is trading more with emerging markets and Asia than with the U.S. – see chart below.

o Increasing restrictions and bans by China of critical minerals needed in industry and manufacturing by the U.S.. See graph courtesy of Economist Sean Foo below:

S2 - Actionable Ideas we are considering in our portfolios:

· Diversify regionally: Allocate capital across U.S., China, and “neutral” economies like Brazil, Mexico, and ASEAN nations.

· Own U.S. reshoring plays (e.g., industrial automation, domestic logistics, advanced manufacturing).

· Hold selective Chinese stocks in strategic sectors supported by state policy (e.g., AI, chips, clean energy), but hedge for policy volatility.

· Monitor trade policy and semiconductors—shift capital based on IP and supply chain announcements.

Scenario S3 – China clearly wins the Trade War (Bull case for China)

Assumptions: Trump fails to re-industrialize the U.S.; China expands market share in EVs, AI, and green tech; emerging markets pivot toward Beijing; U.S. allies fragment.

In this scenario, these considerations and trends are pertinent:

o Violations and extraterritorial extension of rule of law by U.S. causing foreign investors to sell U.S. assets and causing hesitation and concern with setting up businesses in the U.S.. With the U.S. and G7 freezing and “confiscating” assets from Russia for example, this has caused may other Global South countries like China and others to begin selling and/or diversifying U.S. assets and business activity including trade away from the U.S. – this loss of capital and confidence in the U.S. will result in challenging industrial development capital needed for manufacturing and reshoring, and also is causing a negative perception of the strength of the rule of law.

o Tariffs accelerating increasing trade away from the U.S. and toward the Global South – China is clearly benefitting from this trend as countries look to minimize the negative effects of severe U.S. imposed tariffs on their economies. See chart below courtesy of Economist Sean Foo.

S3 - Actionable Ideas we are considering in our portfolios:

· Go long Chinese tech and industrial ETFs, especially those tied to semiconductors, EVs, and infrastructure.

· Increase exposure to Asia EM equities—Vietnam, Indonesia, and India may benefit from China-centric regional growth.

· Reduce exposure to U.S. multinationals heavily dependent on China for supply chains or revenues.

· Watch for yuan appreciation and capital market liberalization—potential bond and equity inflows.

· Long agriculture equities in Brazil, Argentina, and Indonesia as China diversifies away from the U.S. for its imports of agricultural commodities.

· Long Asian and Emerging Market currencies as currencies strengthen relative to the U.S. Dollar.

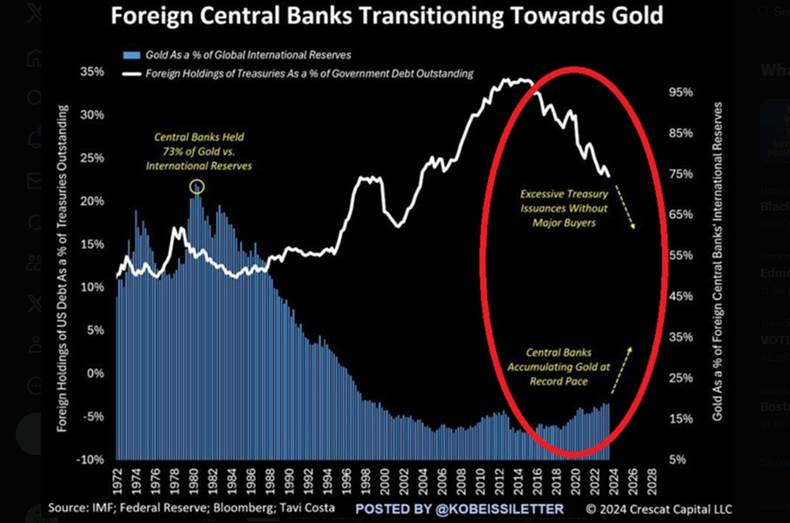

· Long gold as central banks increasingly prefer gold relative to U.S. Treasury Bonds as a neutral reserve currency.

Whether China wins depends on how you define "winning." It may not dominate the U.S., but it could absorb the blows, adapt, and rewire the global economy in its favor. The real story may be not in who wins, but in who bends—and who breaks.

Contact us for more information and for Assistance, Staff Augmentation and Consulting on Geo-Political Risks

Contact us at info@cedarportfolio.com - Art Berman, Yra Harris and the CedarOwl Team - for assistance, staff augmentation and/or consulting on geo-political risk assessment and management services.

Link Here to Art Berman’s Website and Blog

Become a paid subscriber today for full access to all our entire postings at CedarOwl, it includes also access to our CedarOwl model portfolios - for our best offer of less than $5 dollars a month at only $4.92 per month.

Disclaimer: This information and material contained in this post is of a general nature and is intended for educational purposes only. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. This post does not constitute a recommendation or a solicitation or offer of the purchase or sale of securities. Furthermore, this post does not endorse or recommend any tax, legal, or investment related strategy, trading related strategy or model portfolio. The future performance of an investment, trade, strategy or model portfolio cannot be deduced from past performance. As with any investment, trade, strategy or model portfolio, the outcome depends upon many factors including: investment or trading objectives, income, net worth, tax bracket, suitability, risk tolerance, as well as economic and market factors. Economic forecasts set forth may not develop as predicted and there can be no guarantee that investments, trades, strategies or model portfolios will be successful. All information contained in this post has been derived from sources that are deemed to be reliable but not guaranteed.