Will Cryptocurrencies Address the Unsustainable U.S. Debt Crisis?

Transitioning the global USD-based economy and the rapidly rising use of cryptocurrencies results in USD cryptos backed by/with a demand for U.S. Treasuries

As everyone knows, the U.S. is running unsustainable government debts and deficits. Who will finance all this debt? There are several data points and trends indicating how foreign governments like China and other countries are not only either not buying or buying less U.S. Treasury debt, but actually also selling their current holdings at the same time. For the last several decades, the idea of the U.S. spending recklessly on relatively low cost products made in Asia by Asian countries then recycling their USD surpluses back into buying U.S. Treasury debt, thereby lower the value of their currencies relative to the USD, making it attractive for U.S. residents to continue buying their relatively low cost products. That game is now over.

The U.S. could employ financial repression policies to force 401k account holders for example to hold 50% of their account value (total estimated at over $7 Trillion - link here plus trillions more into other retirement related assets) into U.S. Treasury bonds - that would put a bid on U.S. Treasury bonds.

Or the U.S. could take an approach to promote cryptocurrencies including not only private-based cryptocurrencies like Bitcoin (BTC), USD-based cryptocurrencies and also government-based cryptocurrencies. This is what appears to be happening now in the U.S., especially with the cryptocurrency-friendly new administration led by President-elect Donald Trump and a Republican-majority Congress, together with enhanced cryptocurrency-friendly regulators. Could this approach help not only put a bid on U.S. Treasury bonds but also help address the overall challenge of unsustainable government debt - and also serve as an inflation “honey-pot”/”heat-sink” to effectively keep inflation low by capturing all the massive money printing currency in circulation? Yes - let’s explore how below.

Private-based Cryptocurrencies Spurring Interest and Buy-in for Cryptos in General

There is currently great and rapidly increasing interest in cryptocurrencies, spurred by the recent win of U.S. President-elect Donald Trump with a Republican-dominated congress of representatives, highlighting their intention to promote cryptocurrencies into the economy and even potentially as part of government held reserves.

All of this signals a promising shift for the digital asset industry. Unlike previous administrations, the support for Trump is loud, direct, and explicit. With the expectation of policies, regulations, and key appointments in the White House favoring the growth and innovation within the space, the Trump administration appears to be positioning itself to create an environment where the industry can thrive. This support from the highest levels of government could provide the momentum needed to revitalize the blockchain and cryptocurrency industry after the dismal four-year period it appears to be finally leaving. - source link

These developments, together with the recent rise in prices of cryptocurrencies relative to most government-based currencies like the USD, is spurring great interest and momentum into cryptocurrencies, setting the stage and giving confidence for the introduction of government-based cryptocurrencies like CBDCs.

What to make of the Rise and Interest in Cryptocurrencies?

Historically the initial interest and rise in cryptocurrencies was due to:

libertarian minded users attracted by some cryptocurrencies which have a natural limit to their issuance - such as Bitcoin at 21 million coins (although there is discussion to increase this limit) and Ripple XRP at 100 billion coins; in other words cannot be printed indefinitely in a manner similar to government-based fiat currencies;

residents of Venezuela and China looking to get capital out of their countries for whatever reasons, bypassing traditional bank wire transfers which had severe restrictions and capital exchange controls imposed.

For many cryptocurrencies the focus was initially on setting up a digital structure and operational framework for conducting financial-related transactions across the economy locally and globally. The focus has since shifted to holding cryptocurrencies in the anticipation of higher market values, with little or no consideration for use in transactions.

In prior posts, we have mentioned how some cryptocurrencies may be serving, whether intentionally or unintentionally, as an inflation “honey-pot” or “heat sink” - meaning with rising inflation, the idea of diverting capital away from real-world commodities and other hard assets (historically serving as inflation hedges and investment) like agricultural commodities, precious metals, energy commodities and industrial metals, effectively keeping a lid on their demand and price rises - ultimately translating to lower inflation rates overall as the money supply is diverted to the “honey pot” / “heat sink” effect of cryptocurrencies.

The Financialization of Bitcoin and How a Bitcoin Strategic Reserve could enable Big Bitcoin Holders to go into Hard Assets

Related to this “honey-pot” serving, private-based cryptocurrencies like Bitcoin have recently been financialized into various exchange traded structures, funds and other custodian-based trading vehicles. There are many ETFs and various traditional funds and tokenized-based funds holding Bitcoin. This has resulted in Bitcoin moving away from its “limited issuance” advantage. As the Bitcoin market value price has increased dramatically recently, there is now talk of a “Bitcoin Strategic Reserve” in the U.S. at the federal level and through some U.S. states, with the potential for using government funds, debt instruments and even hard assets like U.S. govt land/mineral rights to purchase Bitcoin. Proceeds could then be used to purchase additional hard assets.

Regardless of what happens, the original big advantages of Bitcoin - great infrastructure for fast, low-cost digital transactions across the economy at level 1 instead of introducing added layers of software-based constructs and additional third parties involved, and a limit issuance to help serve as a store of value - are no longer the case. (Contrasted with Bitcoin, Bitcoin Cash holds to the original design of Bitcoin and still offers the opportunity to build a significant global payment network, although requiring much more energy than Bitcoin and with weaker security than Bitcoin.)

Listen to Cantor Fitzgerald (one of the primary dealers of U.S. Treasury bonds) leader Howard Lutnick as he announces a financialization program to help Bitcoin holders to leverage their holdings of Bitcoin (last few minutes):

U.S. Dollar-based Crypto Stablecoins Require Backing of and Purchase of U.S. Treasuries

The heavily indebted U.S. government now has the opportunity to take advantage of the rising trend and interest in cryptocurrencies, especially those that are U.S. dollar (USD) based or backed:

Tether (USDT);

USD Coin (USDC);

Pax Dollar (USDP);

First Digital USD (FDUSD);

Binance USD (BUSD);

Gemini Dollar (GUSD);

Dai (DAI).

These USD stablecoin are backed by U.S. Treasuries (bonds/notes). This process effectively creates a bid for U.S. Treasuries, necessary especially now when many central banks like China, Russia and others are not only no longer buying as much or any U.S. Treasuries but also even selling their current holdings at the same time.

These stablecoins provide a link between the old legacy system of USD accounts to cryptocurrency-based stablecoins. Effectively the USD in the old system are used to purchase U.S. Treasuries in the process of moving to the digitized cryptocurrency system.

The U.S. Department of the Treasury - the Treasury Borrowing Advisory Committee (TBAC) - has recently put out a report indicating this - download the entire report here:

A couple key slides:

Could Bank Deposits and U.S. Economic Transactions Help Address the U.S. Government Debt Crisis Challenge?

Consider that the U.S. economy is approximately at 29 Trillion. Consider also that the total USD value of world merchandise trade (as measured by the average of exports and imports) at US$ 24 trillion. Plus consider USD bank deposits globally.

Now consider the U.S. national debt at $36 Trillion.

You can see how a transition of these transactions and deposits into USD stablecoins that represent purchases of U.S. Treasuries and it can be clearly seen how this transition could help address the U.S. Government debt crisis challenge.

Government-Based Cryptocurrencies - Central Bank Digital Currencies (CBDCs)

While the demand for these USD-based stablecoins can help the U.S. Government debt crisis, we see the rise and interest in cryptocurrencies in general as a precursor to gain momentum and acceptance by the general public of up-coming government-based cryptocurrencies such as Central Bank Digital Currencies (CBDCs). CBDCs will help governments to control all aspects of the economy on all economic transactions. Through software-based controls, governments can configure, monitor and control these government-based cryptocurrencies.

Governments can allow Commercial Banks to Implement CBDCs

The implementation and operations of government-based cryptocurrencies as Central Bank Digital Currencies (CBDC) is likely to be done by commercial banks not central banks for a few reasons:

commercial banks already have direct client relationships in place;

commercial banks are already under required government regulations;

in many countries, it is difficult for central banks to have visibility of client bank accounts due to privacy regulations or the necessity of filing warrants to gain this visibility.

Referencing again the U.S. Department of Treasury report, here is an interesting slide which indicates how the lower right quadrant is the target - commercial private banks implementing permissioned (controlled) CBDCs:

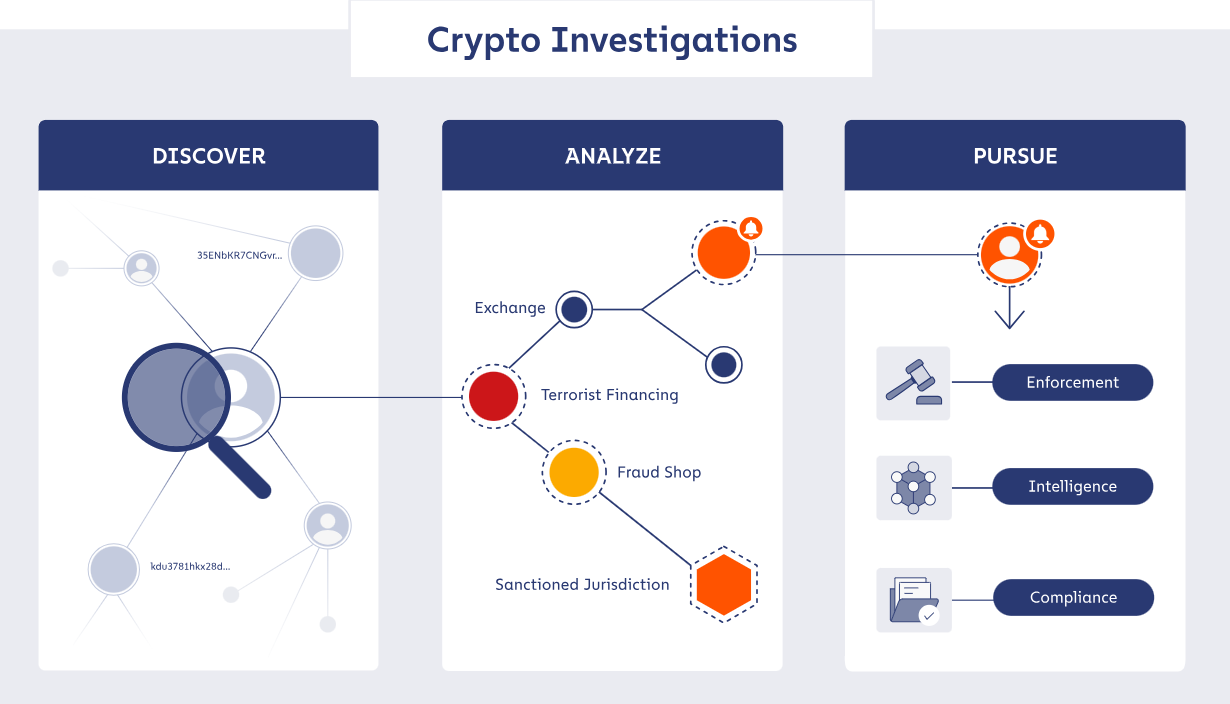

Governments can monitor both Govt-based and Private-based Cryptocurrencies

The very nature of blockchain is a well-documented ledger of transactions. Yes there are encrypted messaging and VPN networks involved but a growing list of companies are now able to provide chain analysis services, using state-of-the-art technologies, artificial intelligence, and investigative analysis techniques. We highlight one company here - Chainalysis.

Potential Catalysts for Implementation of Digital IDs and CBDCs

Under what circumstances will government-based cryptocurrencies like CBDCs be implemented? This is a good question. Some thoughts:

Implementation of “permissioned” CBDCs will require some sort of Digital ID first as CBDCs are digital based and require a form of digital ID to operate - one potential catalyst could be a desire by residents to be identified relative to non-citizens or illegal migrants for border security and for voting;

Implementation of “permissioned” CBDCs could be offered initially on a voluntary basis and later on a mandatory basis, and could be triggered in the event of a financial crisis such as a bond debt crisis necessitating action to prevent a bond market meltdown for some reason. Voluntary uptake could be facilitated by offering a free $200 or free tokens that can be used for travel or entertainment.

Adverse Risks of CBDCs on Personal Freedoms and Liberties

While there are advantages of streamlining currency transactions and settlement execution times, there are adverse risks of cryptocurrencies which should be considered and addressed:

for all cryptocurrencies, there is always the risk of a cyber attack, widespread power outages or Internet downtimes which would prohibit or make it much more difficult to access or use;

for all cryptocurrencies, there are security and privacy risks relating to data or access compromises or mis-uses;

for government-based cryptocurrencies like CBDCs, while there will no doubt be secure infrastructures in place to operate, there remains significant adverse risks relating to privacy, liberties and freedoms of financial transactions being monitored and controlled by government entities - for example, transactions or entire accounts could be cancelled, frozen or suspended based on non-aligned political agendas, non-aligned climate change views or on capital controls (like not allowing cryptocurrencies to be used outside of one’s country). Any restriction or control can be configured and implemented in government-based cryptocurrencies, enabled through the software nature of their constructs.

Positive Ideas

* Suggestion on actions and positive ideas:

encourage the setting up of a Digital Bill of Rights, emphasizing the implementation and operations of private-based and government-based cryptocurrencies to foster security and privacy provisions as well as to maintain and enhance freedoms and liberties of the users of the cryptocurrencies including the associated platforms and providers;

perform due diligence of cryptocurrencies to assess for stability, viability, store of value and preservation of purchasing power; here is a list of cryptocurrencies which have limits in their issuance - generally it does not mean that in the future a software-settable limit in many of them (including Bitcoin) could not be changed arbitrarily to a higher number - currency dilution with similar effects like government fiat currencies:

Bitcoin (BTC): Capped at 21 million coins

Litecoin (LTC): Modeled after Bitcoin, Litecoin has a maximum supply of 84 million coins

Cardano (ADA): The total supply is capped at 45 billion ADA tokens.

Binance Coin (BNB): Initially set at 200 million tokens, Binance employs a token burn mechanism, periodically reducing the supply to eventually reach 100 million BNB.

Chainlink (LINK): The total supply is fixed at 1 billion LINK tokens.

Bitcoin Cash (BCH): As a fork of Bitcoin, it shares the same maximum supply of 21 million coins.

Bitcoin SV (BSV): Another Bitcoin fork, BSV also has a 21-million-coin cap.

Zcash (ZEC): This privacy-focused cryptocurrency has a maximum supply of 21 million coins.

Dash (DASH): Dash has a maximum supply of 18.9 million coins.

Monero (XMR): Monero has a capped supply of 18.4 million coins.

Solana (SOL): Solana has a capped supply of 489 million SOL tokens.

Avalanche (AVAX): Avalanche has a capped supply of 720 million AVAX tokens.

VeChain (VET): VeChain has a capped supply of 86.7 billion VET tokens.

Tron (TRX): Tron has a capped supply of 100 billion TRX tokens.

Neo (NEO): Neo has a capped supply of 100 million NEO tokens.

diversify into cash for cash-based transactions in addition to using digital cryptocurrencies for digital-based transactions - recent events in Tennessee, North Carolina and New Zealand have highlighted the benefits of having some physical cash on hand in the event of emergencies - digital currencies require power and energy systems to be up and operational, and may fail also during cyberattacks or virus vulnerabilities in the Internet infrastructure; even authorities in Norway have decided to increase the 3% cash levels in the country to foster more diversification and risk mitigation in the general economy, not just covering for emergencies.

In our portfolios, we provide consideration for some investment holdings into currencies that have characteristics of serving as stores of value with ability to preserve purchasing power. Also it is noteworthy to point out that we prefer holding wealth in the form of hard assets, some of which are physical in nature and some of which are financial-based like currencies or equities with a hard assets focus. Link here to see our portfolios we use.

We also maintain a risk table monitoring and assessing key geopolitical risks and financial repression-related risks, including but not limited to cryptocurrency risks, as well as associated risk mitigation measures and actions to help mitigate these risks. Link here to view our risk table.

Disclaimer: This information and material contained in this post is of a general nature and is intended for educational purposes only. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. This post does not constitute a recommendation or a solicitation or offer of the purchase or sale of securities. Furthermore, this post does not endorse or recommend any tax, legal, or investment related strategy, trading related strategy or model portfolio. The future performance of an investment, trade, strategy or model portfolio cannot be deduced from past performance. As with any investment, trade, strategy or model portfolio, the outcome depends upon many factors including: investment or trading objectives, income, net worth, tax bracket, suitability, risk tolerance, as well as economic and market factors. Economic forecasts set forth may not develop as predicted and there can be no guarantee that investments, trades, strategies or model portfolios will be successful. All information contained in this post has been derived from sources that are deemed to be reliable but not guaranteed.