Will Japan Dumping U.S. Debt cause a Global Market Implosion?

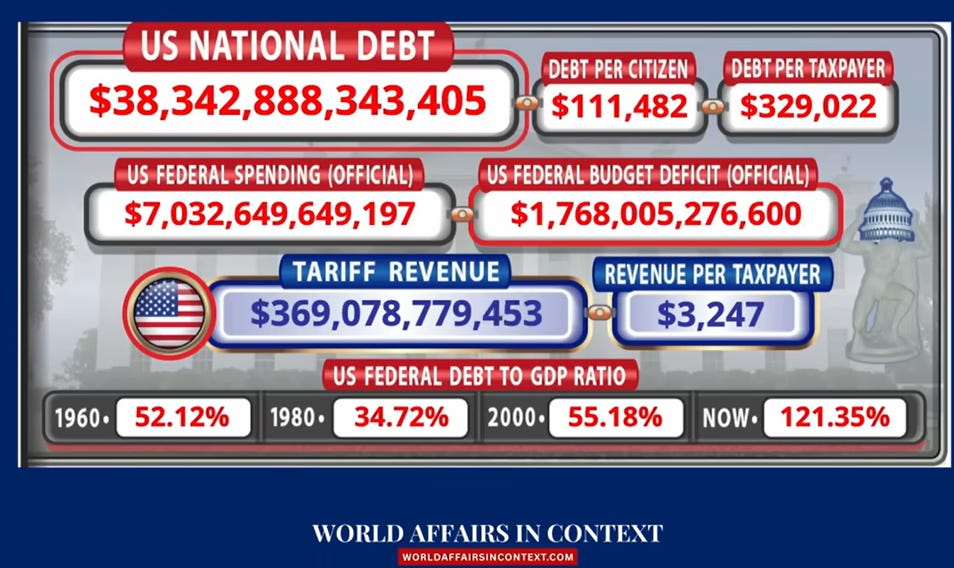

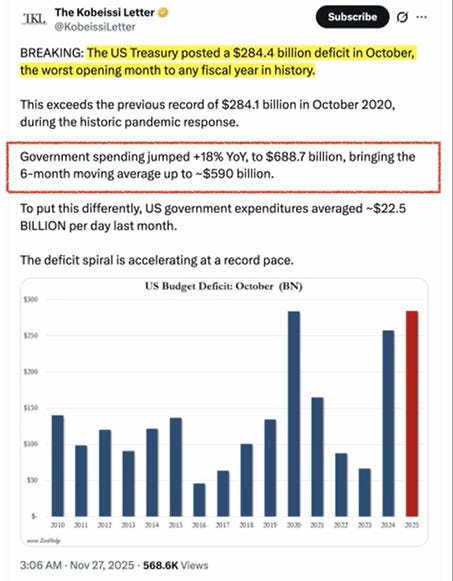

The era of the U.S. getting global buying of its unsustainable debt to finance its reckless spending is over

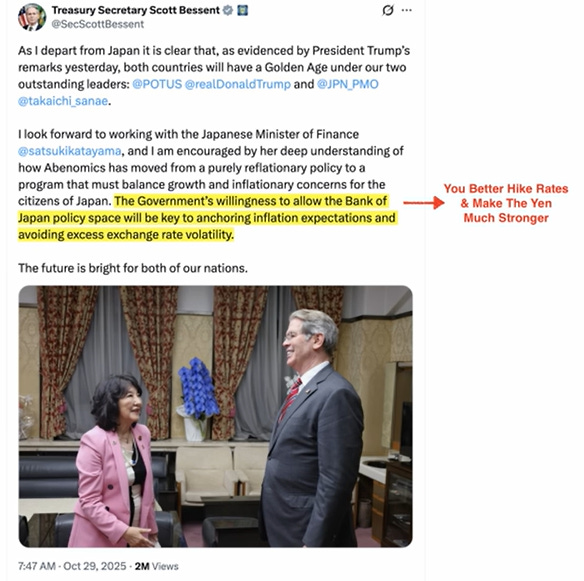

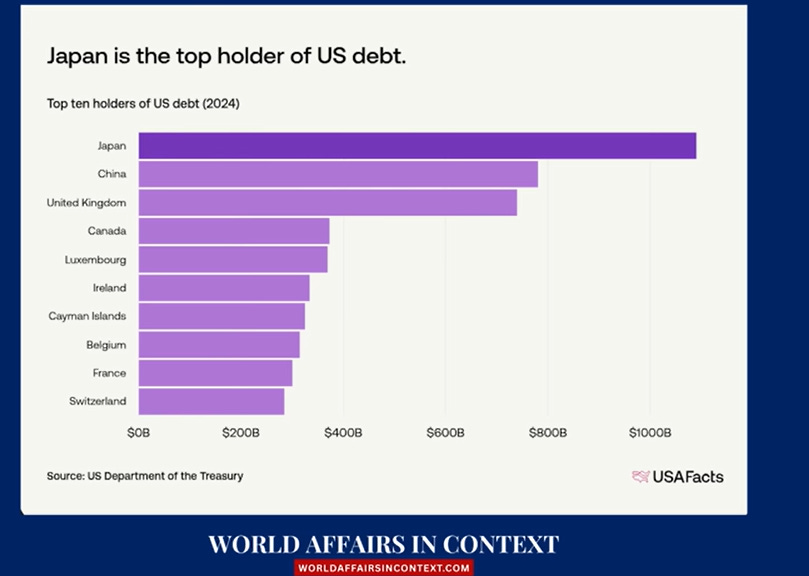

For many decades now, the U.S. has been able to continue its reckless government spending, given that this spending has been covered by global buying of its debt - but now that game is over. Foreign central banks and governments are either no longer buying U.S. government bonds, but even now selling their holdings slowly and quietly. Japan is the biggest holder of U.S. government bonds - the big question is will they sell their holdings to help their current dire financial and economic situation?

Let’s explore this question in more detail. References are made to some great podcasts by economists and podcasters Sean Foo and Lena Petrova (World Affairs in Context podcast).

Japan is in a bind with no clear and easy way out

Great charts and references by Sean Foo below explain the bind:

Will Japan sell some or all of its large U.S. government bond holdings to help Japan get out of its bind?

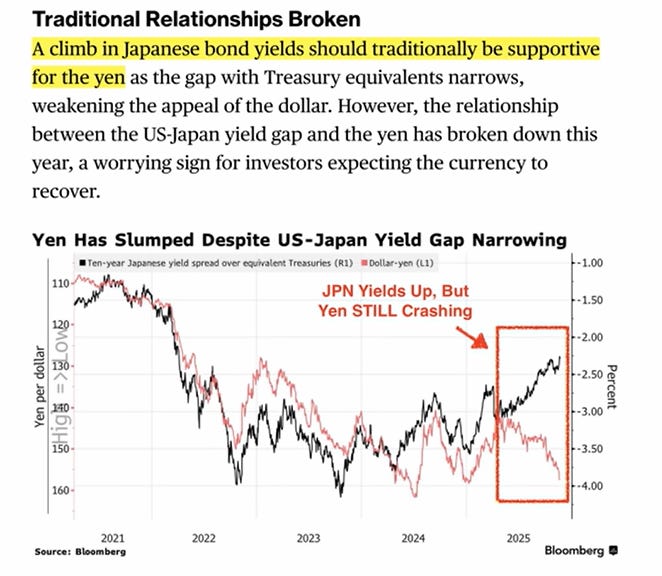

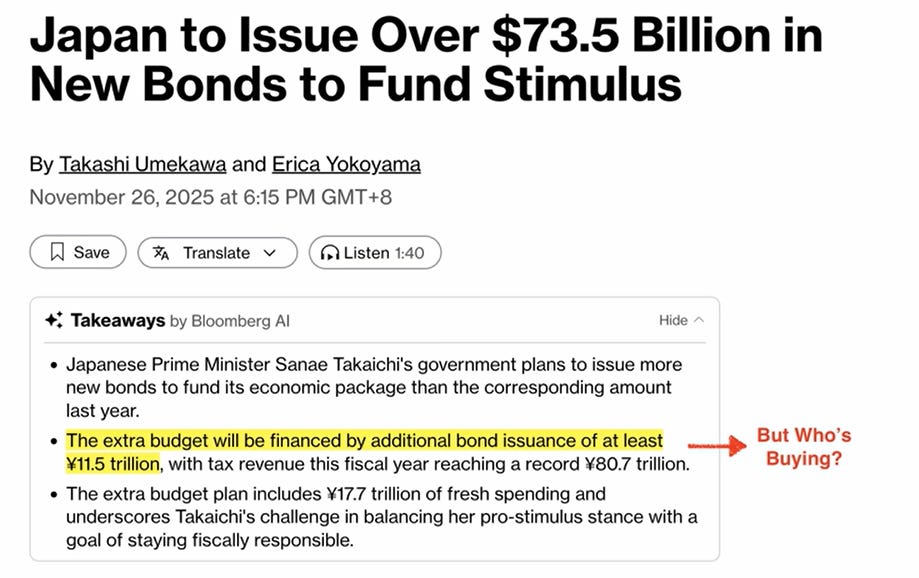

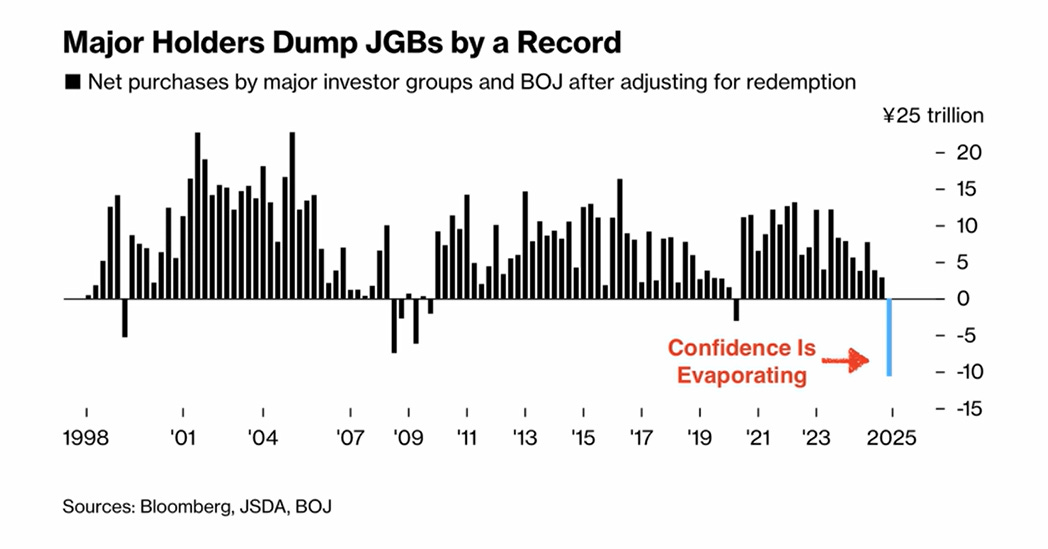

“Japan’s new multi-billion-dollar stimulus package has triggered market turmoil, sent the yen plunging, and raised serious questions about the future of U.S. borrowing. With the yen hitting its weakest levels in nearly a year, Japan’s finance ministry is signaling possible intervention—but markets aren’t convinced. Economists warn Japan’s aggressive spending could unintentionally destabilize the U.S. economy, especially as Japanese government bonds and the yen fall simultaneously, a rare and alarming signal of capital flight and market distrust.

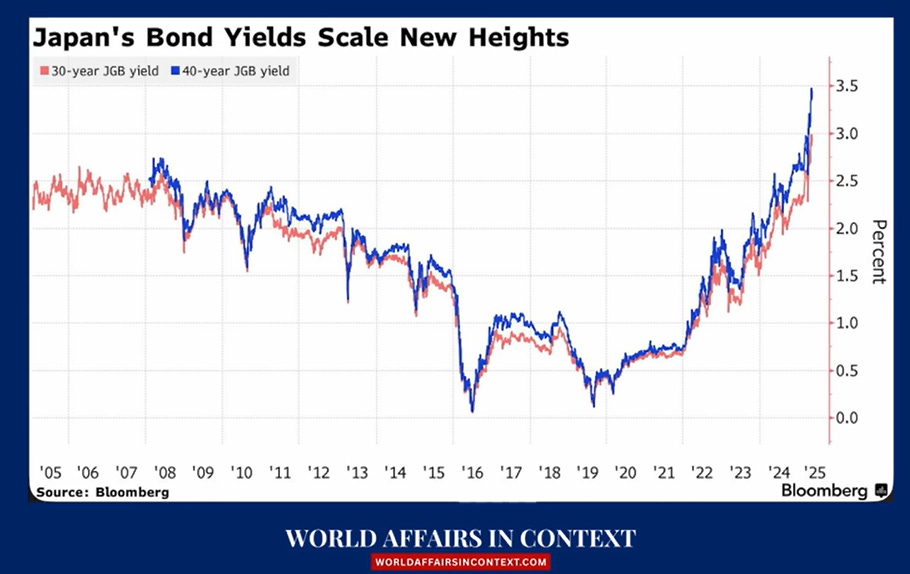

For decades, Japan has been America’s biggest foreign lender, buying trillions in U.S. Treasurys and keeping American borrowing costs low. But that era is ending. With domestic Japanese bond yields soaring to 20- and 30-year highs, investors now have strong incentives to bring their money home. In just one quarter, they dumped $62 billion in U.S. Treasurys—an exit that analysts warn could push U.S. yields even higher.

This shift affects YOU: mortgage rates near 7%, record credit-card APRs, rising car-loan costs, and a U.S. government suddenly facing higher borrowing rates after 40 years of cheap money fueled by Japan. As Japan battles aging demographics, 235% debt-to-GDP, weak currency, and rising geopolitical tensions with China, the country no longer has the capacity to subsidize America’s spending.

Even more dangerous: an unstable yen threatens the global “carry trade,” which supports everything from U.S. stocks to emerging markets. A carry-trade unwind could trigger rapid market volatility—something analysts at BlackRock, Morgan Stanley, and Société Générale say is now a real possibility.

This is a financial turning point. The era of easy money is over. The world is shifting. And understanding this transition is essential for protecting yourself and your finances.”

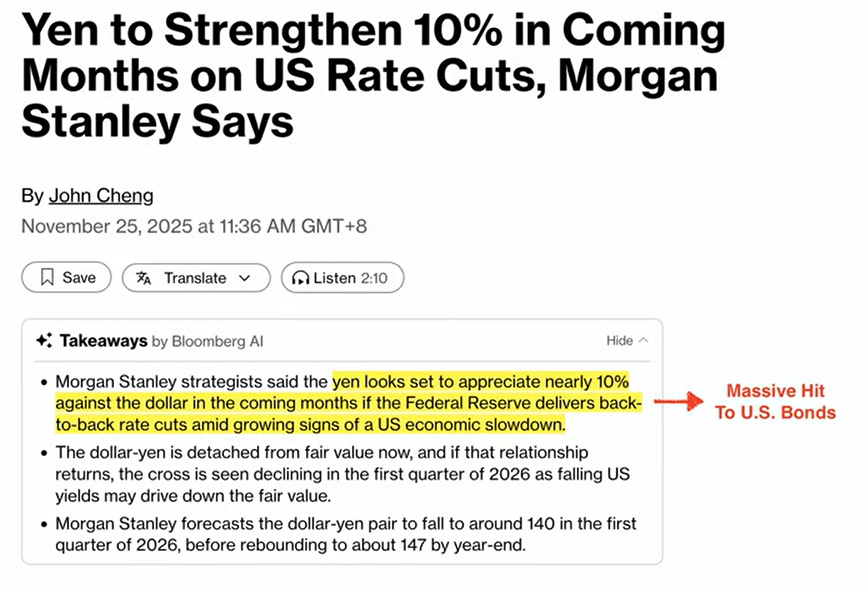

The most important data point is the below, if Japanese investors begin repatriating their money from overseas as the Japanese Yen strengthens:

As noted, this would translate into a massive hit to U.S. bonds.

Are we going to see a repeat of the 2019-2020 Emerging Financial Crisis and Lockdowns?

Remember what happened in September 2019 when the plumbing of the financial system, the repo market, went into crisis mode - while it calmed down a bit over the next few months, by the third week of March 2020 the repo markets flared again. There are some economists and observers (for example Maneco and a former Goldman Sachs Managing Director) that think that the Covid lockdowns and ensuing massive liquidity resulting from them was a “cover” for this emerging financial crisis - watch/listen to the video below.

Note how liquidity increased slightly in Sept of 2019 and then again starting from March 2020.

Given it took six months from September 2019 to March 2020 for the repo crisis to flare up again, could there be a rhyming timeframe from Oct/Nov for perhaps a shorter period of time say the mid to late January 2026 time-fame? A “risk-off” event then could again trigger a massive liquidity surge. Remains to be seen.

Supporting this potential scenario are also some data points from economist and geopolitical analyst Alex Krainer in his latest posting on “The viruses are coming, the viruses are coming!”

“A recent TrendCompass heading read, “Are new & improved lockdowns coming?” In that article, I referred to a few strange news items that seemed to point to the possible imposition of new lockdowns in the near future. First, there was the bizarre 1,531-page COVID-19 inquiry by Baroness Heather Hallett DBE. The Baroness wasn’t concerned about accountability for one of the greatest trainwrecks in human history or who was behind it. Her main concern was about how to do it right the next time.

Then there was EU Commission president Ursula von der Lying who mentioned, in passing, during her State of the Union speech in September that “We are on the brink, if not even at the start of another global health crisis.” Then we had warnings from the ECB that the financial system is becoming unstable. Six days after my report, on 27 November, Reuters - the ever truthful news service - announced that, “Bird flu virus could risk pandemic worse than COVID 19 if it mutates…”

According to Reuters, the truth, the whole truth, and nothing but the truth of the matter is that the evil, invisible enemy, “could affect healthy individuals, including children, unlike COVID-19.” Furthermore, some experts say that people lack antibodies against bird flu and respiratory infections. How do they know? They must have looked into people’s antibody tanks and found them empty. Thankfully, “preventative measures exist, including vaccine candidates and antiviral stocks.” Well, thank goodness for that - lucky us!”

Implications to our Investing

Of course this is all money printing and direct money supply creation into the economy, and will result in inflation. How are we investing in this environment?

Let’s delve in …

Become a paid subscriber today for access to the below, and to our entire postings, and to our model portfolios - for our best offer of less than $5 dollars a month.