Will the U.S. Department of Government Efficiency (DOGE) work?

Good Intentions but Not Likely to Work - Here's Why

The idea of of the proposed new commission in the U.S. called the Department of Government Efficiency (DOGE). Its mandate is restructuring the government, minimizing government expenditures and improving the efficiency of the regulatory environment. Who can complain against that? After all, Argentina led by new President Javier Milei is doing this and making great progress. Will it work in the U.S.? - No, here is why.

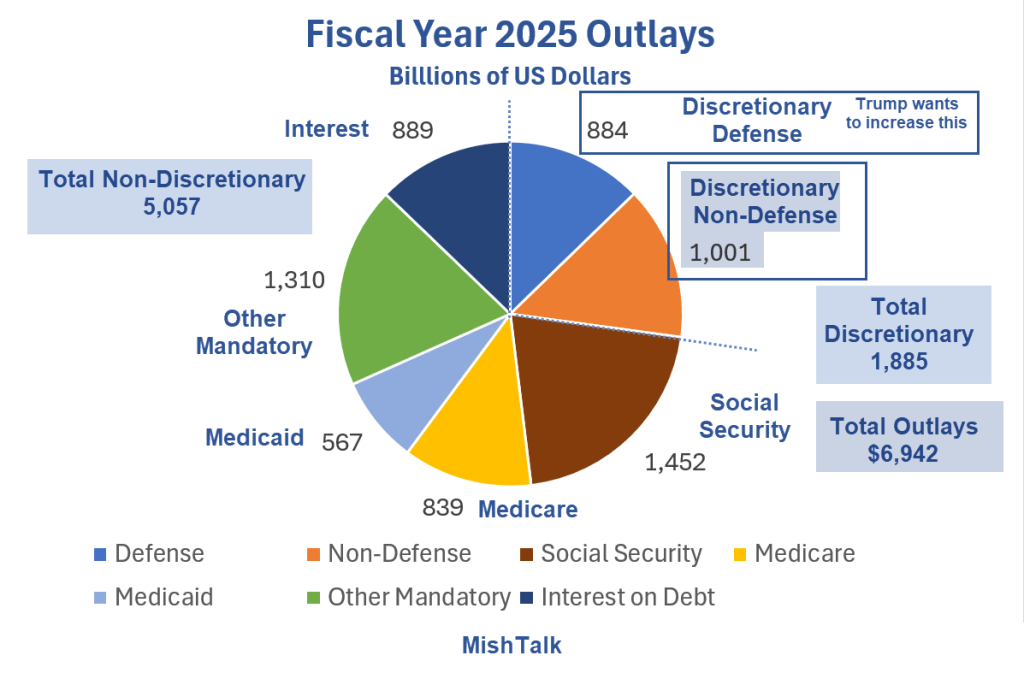

The federal budget of the U.S. is about USD $6.9 Trillion - link here.

Federal receipts of the U.S. are about USD $4.9 Trillion - link here.

Therefore deficits are now almost USD $2 Trillion - link here.

Although there are upwards of over USD $200 Trillion in unfunded liabilities, the level of U.S. national debt is currently over USD $36 Trillion. The interest payments on this are over USD $1 Trillion per year - link here.

You can see that soon the federal deficit will be simply paying the interest on the national debt - sort of like having to borrow to pay the minimum payment on a credit card where the total debt owed still keeps going higher!

One of our ten Most Admired Advisors (MAA) Chris Wood observes below:

“If you look at net interest payments + entitlements, they were running in the 12 months to September 2024 at 91% of total federal government receipts. So basically there is no room for maneuver on the fiscal situation in the US in any kind of real downturn.” - Chris Wood, source link

(To read our entire MAA report update for all ten MAAs, consider becoming a paid subscriber.)

So what is likely to be the work output of the U.S. DOGE? Our view:

There will be some minor cuts in the federal budget, but not to any significant or meaningful extent. If they are lucky like USD $1 Trillion:

“Anyone with an ounce of common sense knew that wasn’t possible. He won’t find $1 trillion either.” - Mish Shedlock, source link and chart below

The work output will eventually include a statement that the U.S. DOGE has done its due diligence and tried its best to make cuts and it has done the best and maximum that can be done. The wording will provide assurance to the public in this regard.

In the meantime, the currency will be devalued and depreciated significantly in the coming years - meaning a significant lowering in the purchasing power of the currency. Meaning social security payments will be maintained as promised but in the future the payments may only be able to afford a few cups of coffee per month.

Another of our ten MAAs, Dr. Marc Faber discusses some of the above points in more detail in this recent podcast. Dr. Faber has written about these themes and trends for many years.

Another goal of the U.S. DOGE is for efficiency improvements in the regulatory environment in the U.S. - with the hopes of fostering innovation and entrepreneurialism, thereby bolstering economic growth? We have written on this topic in several postings - here is one:

Unless some or all of the suggested positive ideas from our posting are implemented, it is highly unlikely that the U.S. DOGE will improve on the regulatory environment in any significant or meaningful way as well.

As such we do not see an Argentina-style “chain-saw” change in making government smaller, more efficient and fostering and environment conducive for innovation and entrepreneurialism. Argentina had to suffer through decades of suffering and worsening economic conditions before the population was finally ready to accept this change.

Disclaimer: This information and material contained in this post is of a general nature and is intended for educational purposes only. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. This post does not constitute a recommendation or a solicitation or offer of the purchase or sale of securities. Furthermore, this post does not endorse or recommend any tax, legal, or investment related strategy, trading related strategy or model portfolio. The future performance of an investment, trade, strategy or model portfolio cannot be deduced from past performance. As with any investment, trade, strategy or model portfolio, the outcome depends upon many factors including: investment or trading objectives, income, net worth, tax bracket, suitability, risk tolerance, as well as economic and market factors. Economic forecasts set forth may not develop as predicted and there can be no guarantee that investments, trades, strategies or model portfolios will be successful. All information contained in this post has been derived from sources that are deemed to be reliable but not guaranteed.