Will there be a Plaza Accord 2.0? Trends Accelerating De-Dollarization

Implications for the Global Economic and Investment Environment

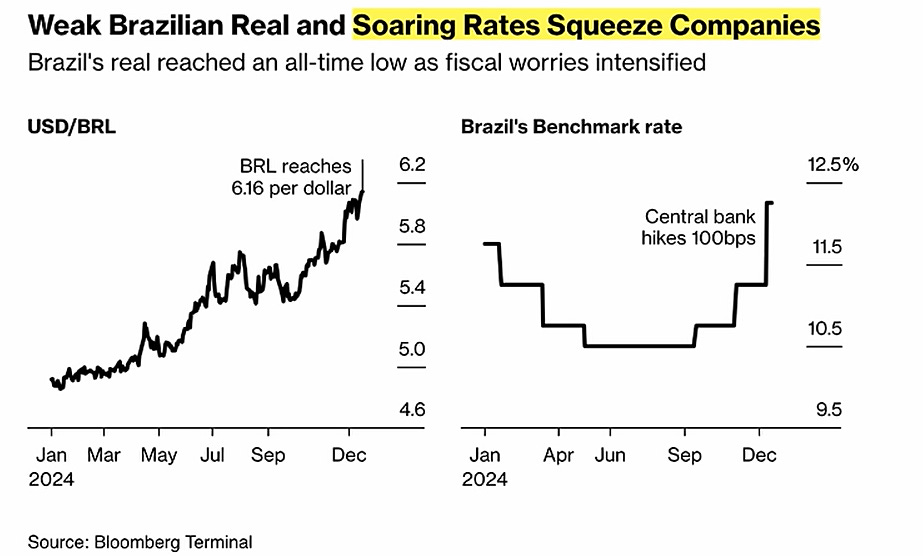

The U.S. Dollar (USD) has strengthened in recent months, and may continue to do so should a significant “risk-off” event happen or should current wars around the world escalate, causing capital to flee toward the U.S. as a safety trade. In addition the U.S. Federal Reserve central bank is signaling less cuts in interest rates - this is effectively strengthening the USD. This USD strengthening is wreaking havoc in emerging markets where there has been relatively high USD reserve holdings or relatively high borrowing in USD.

For example, Brazil as an emerging market is having challenges in this regard - its currency has been sliding over 20% weaker relative to the USD this year. As a result, Brazil has just unloaded $17 Billion in USD in an attempt to bolster its currency:

The currency challenges in emerging markets are fostering de-dollarization as emerging markets in the non-G7 world look to doing trade in non-USD currencies, to be able to take away the USD currency risks adversely affecting their economies.

There are a number of trends that are also accelerating this de-dollarization:

geo-political - with the G7 initially freezing Russian holdings of G7 government bonds, then later confiscating the proceeds from the distributions of these bonds and directing the proceeds of these distributions to Ukraine, much of the non-G7 world is taking note and proactively and quietly selling their holdings of G7 government bonds, especially U.S. Treasury bonds.

“I genuinely believe that the decision taken by the West to seize Russian assets in 2022, including assets of oligarchs that had nothing to do with Putin, amounts to a massive shift in the global financial architecture.” - Louis-Vincent Gave, source link

economic - the new U.S. administration is threatening to levy significant tariffs on trade partners - this will likely backfire with the trade partners likely to increasingly shift away from the U.S. and shift to non-U.S. (non-G7) trade partners - take note on how China recently has shifted buying soybeans away from U.S. farmers and toward Brazilian farmers instead. We would not be surprised to see the U.S. trade partners retaliate by selling an equivalent dollar value in U.S. Treasury bond holdings to pay for the levied U.S. tariffs.

Much of the world is beginning to move away from the USD by selling USD or selling USD-based U.S. Treasury bonds, or selling both:

Japan may increase its sales of U.S. Treasury bonds in 2025 as it tries to stabilize its weakening currency:

While the trend may be a shift to a world using less USD in global trade, an interesting trend is emerging of how the remaining USD is being handled: in Asia, USD is being increasingly kept in Asia instead of being recycled into U.S. Treasury bonds and into U.S. equities, and USD is being used as the base currency for USD-denominated bonds issued by China:

China is beginning to issue USD-denominated bonds in Saudi Arabia and Hong Kong:

“While China’s newly issued bonds were available to investors globally, officials last week said they would be sold in Saudi Arabia, an unusual venue given that London, New York and Hong Kong are normally picked for such transactions. But the choice comes after recent efforts to boost economic ties. Officials from both countries met earlier this year to discuss cooperation, and the warming relations can be seen in moves such as a doubling of investment in Saudi Arabia by China’s biggest steel producer.” - source link

What does all this mean? We think it is indicating these trends:

The world is moving away from the USD in global trade, especially in the BRICS+ or non-G7 world.

While the USD still maintains the leadership in global reserve currency, the world is moving toward currency reserves that are more neutral - like gold - link here to video on X.

The world is moving away from the adverse U.S. economic, political and financial influence and associated risks by transitioning to using non-USD currencies in global trade and by issuing USD-based bonds through BRICS+ countries like China (trading through Hong Kong and Saudi Arabia, not through G7-based New York or London).

Could there be a Plaza Accord 2.0?

There remains the possibility of a global adjustment in currencies. Here one of our Most Admired Advisors (MAA) Louis-Vincent Gave reflects:

“In interview after interview, appointed U.S. Secretary of the Treasury Scott Bessent has talked about the need for a Mar-a-Lago Accord [Plaza Accord 2.0]. Back in the 1980s, the dollar was super high, while the yen and the deutschmark were super low. So in 1985, Treasury Secretary James Baker got all the players together at the Plaza Hotel in New York, where they agreed to bring down the dollar and push up the other currencies [Plaza Accord]. And in so doing, they unleashed a massive boom all over the world. And by the way, the mid-1980s is a time Trump remembers fondly, because that’s when he started to became a big household name. Bessent today says there needs to be a grand global economic reordering, and that he wants to be a part of it.

I can’t attach a probability to it, but it’s perhaps the right tail risk that investors aren’t pricing in today: The possibility that Trump comes in, calls China and Japan over to do a Mar-a-Lago Accord, where they agree to revalue their currencies and agree to build factories in the US. Trump can then turn around and say he made the best deal ever with the Chinese, that he’s the master negotiator and then he can sell more copies of ‹The Art of the Deal›. And everybody’s happy.” - Louis-Vincent Gave, source link

On the other hand if this Plaza Accord 2.0 does not happen and the U.S. tariffs trigger a global trade war, we could see disaster in the global economy and financial markets.

What happened to the USD and Japanese currencies after Plaza Accord 1.0? Let’s look at the chart:

Clearly the USD weakened, but notice how the Japanese Yen currency strengthened. If we get a Plaza Accord 2.0, yes this will likely weaken the USD and emerging markets may benefit, but a strengthening Japanese Yen currency today could likely trigger an unwinding of the Japanese Yen carry trade, effectively serving as a liquidity drain on the global economy and financial markets - the big question is if this could overall cause a “risk-off” event globally in the financial markets. Recall in the past year or so there has been a bit of this unwinding of the Japanese Yen carry trade and it was definitely a risk-off event on the financial markets.

However, a Plaza Accord 2.0 would definitely include participation and actions by Japan, and therefore a likely managing of the Japanese Yen currency would likely happen, thereby minimizing the global market risk-off effects of a potential strengthening of the Japanese Yen currency in the aftermath of a Plaza Accord 2.0 - and as noted earlier above in this posting, Japan would likely welcome some pressure for the Japanese Yen currency to stabilize and strengthen a bit.

What are the implications of all the above considerations for the economy and the financial markets?

Let’s delve in …