Addressing Carbon Emissions Globally with no need for Carbon Taxes, Subsidies, or Grants

And how we are investing in agriculture given global trends - with China shifting to the Global South and away from the United States

Imagine solving the world’s carbon emissions challenge without resorting to carbon taxes, carbon credits, lockdowns, or draconian restrictions on personal liberties and freedoms.

Imagine also enhancing human health at the same time with the same solution.

And imagine enhancing the profitability of businesses involved with implementing this solution.

We recently proposed this solution in a recent posting. We want to share this posting again as there are many countries and jurisdictions imposing more and more carbon taxes. Not only are these carbon taxes not necessary, but they are simply in most cases going into the general fund of governments and jurisdictions, with no follow-up or associated environmental projects.

Our approach to environmentalism is based on four principles called Market Environmentalism, which are derived from the principles of the Austrian School of Economics which forms the basis of our economic philosophy and investment approach. Learn more about this here at our link.

Link Here to our Posting or simply listen to our Deep Dive Podcast:

Deep Dive Podcast - How Regenerative Agriculture can solve the World's Carbon Emissions Challenge, Enhance Farm Profitability and Enhance Human Health all at the same time!

CedarOwl is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

How we are investing in agriculture given global trends - with China shifting to the Global South and away from the United States

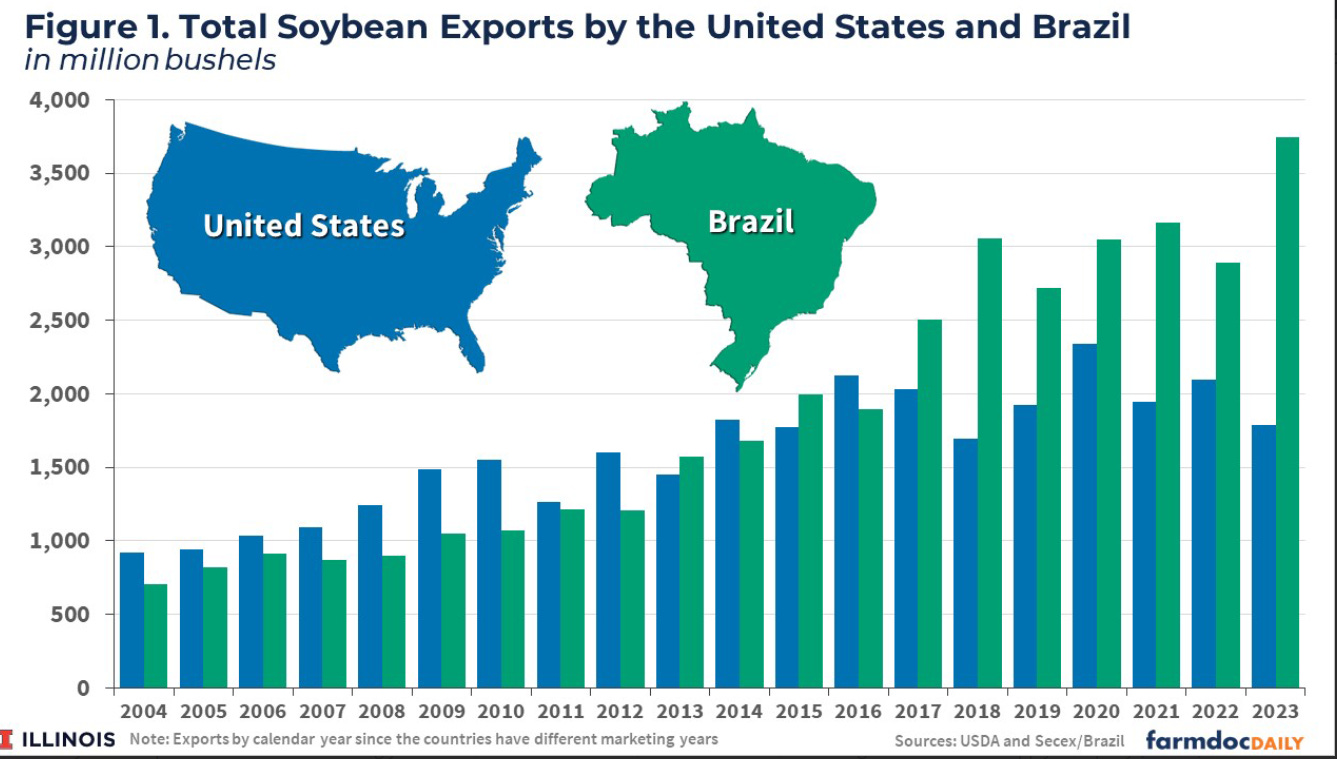

Given the ongoing and intensifying tariff trade challenges, China is diversifying away from getting its agricultural commodities from the U.S. to getting them from Brazil.

“Brazil’s soybean market share rose to 71%, while the US share shrank to 21%, according to Reuters calculations based on the data. Imports from smaller supplier Argentina more than doubled to 4.1 million tons in 2024 from 1.95 million tons in 2023.”

We are putting together a report for next week’s substack posting here on how we are investing in agriculture and in our model portfolios.

Become a paid subscriber today for access to the below, and to our entire postings, and to our model portfolios - for our best offer of less than $5 dollars a month - only $4.92 per month.

Disclaimer: This information and material contained in this post is of a general nature and is intended for educational purposes only. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. This post does not constitute a recommendation or a solicitation or offer of the purchase or sale of securities. Furthermore, this post does not endorse or recommend any tax, legal, or investment related strategy, trading related strategy or model portfolio. The future performance of an investment, trade, strategy or model portfolio cannot be deduced from past performance. As with any investment, trade, strategy or model portfolio, the outcome depends upon many factors including: investment or trading objectives, income, net worth, tax bracket, suitability, risk tolerance, as well as economic and market factors. Economic forecasts set forth may not develop as predicted and there can be no guarantee that investments, trades, strategies or model portfolios will be successful. All information contained in this post has been derived from sources that are deemed to be reliable but not guaranteed.