CedarOwl’s Live Geopolitical Investment Risk Table

Geo-Political and Financial Repression-related Risks We are Assessing

Link to our Risk Table

(refresh the screen for updates)

We’re a new economics and finance publication with a penchant for environmentalism featuring new releases every single week.

Is it getting hot in here? Maybe a little cramped? Are we upside down or right side up? Right now, staying privy to geopolitical events in the worldwide markets is crucial for investors, supply chain managers, risk professionals, and other stakeholders. We are excited to announce the availability of our comprehensive Risk Table—a continually updated spreadsheet matrix that identifies and assesses geopolitical risks globally. Updated weekly and accessible to the public, this tool provides a birds-eye view of threats varying in level and likelihood, helping investors and clients of professionals stay ahead of potential disruptions.

Our live Risk Table, linked at the top and bottom of this article, evaluates a wide range of geopolitical risks, including government fiscal policies, central bank actions, and regulatory changes.

Real-world examples of these risks include:

Nationalization of businesses or properties by a country.

Expropriation or freezing of assets.

Imposition of new industry-specific regulations.

Commodity export bans.

Changes in rules governing retirement accounts like 401(k)s, RRSPs, and Superannuation.

Regional conflicts or wars impacting economies and markets.

And more that will develop over time.

We invite all of our subscribers to join the dedicated CedarOwl Risk Table chat where these items can be discussed amongst community.

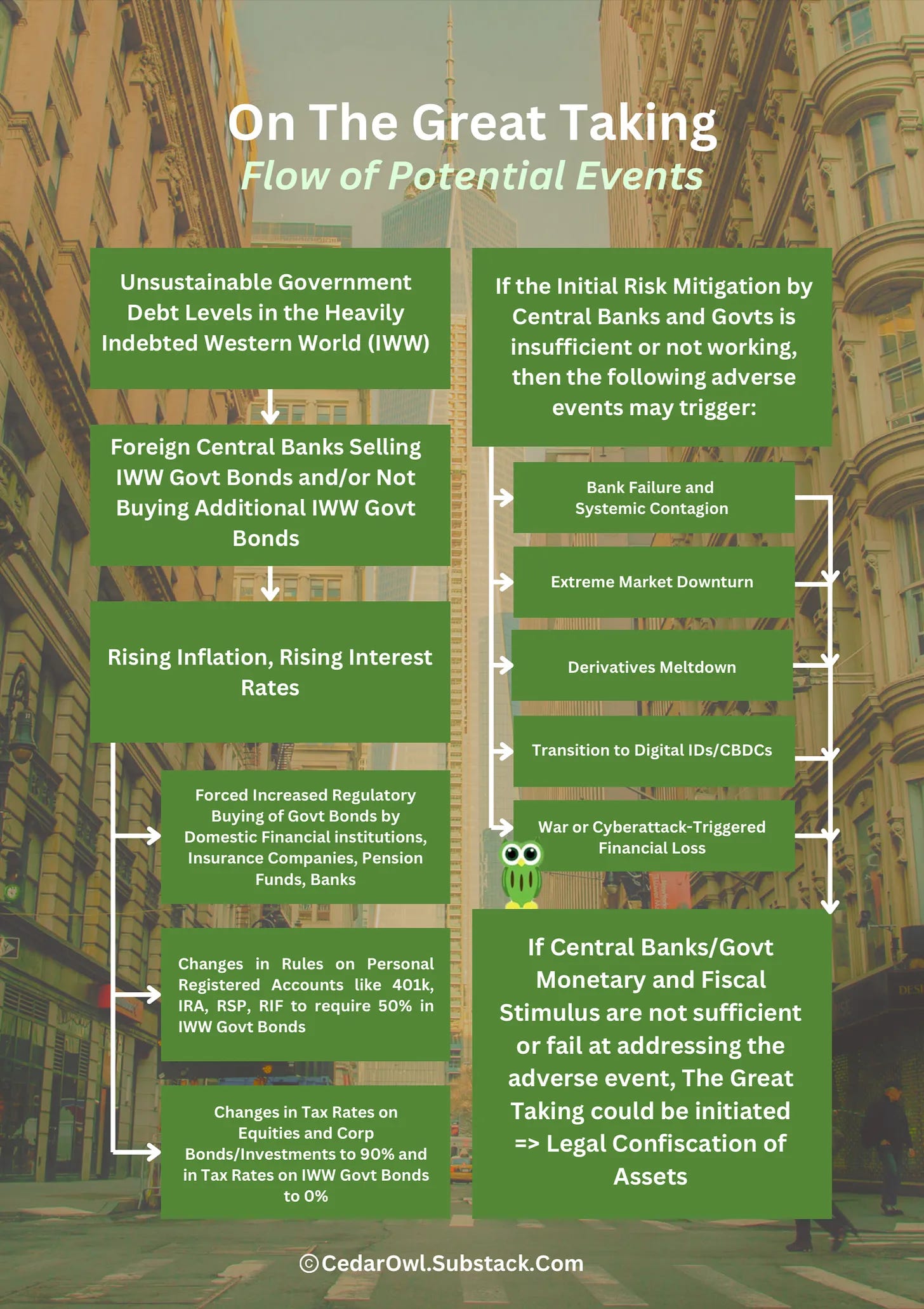

Understanding and preparing for these risks is vital. For instance, our Risk Table includes strategies for mitigating the potential risk of asset confiscation, as detailed in "The Great Taking" book, which is available for download. Additionally, we discuss specific tactics like "DRS Transfers," which allow asset ownership directly in your name, reducing reliance on brokerage firms.

Feel free to download these diagrams here below - CedarOwl’s “The Great Taking” Risk Mitigation Flowchart and Risk Table:

View Our Risk Table

LINK HERE TO OUR RISK TABLE

(refresh your browser screen for updates)

We try to provide as much free value to our professional and enthusiast audience as we can, including this ongoing Risk Table & adjacent chat room, so that our paid community is full of votes of confidence. By subscribing, you gain access to our live Risk Table, ongoing articles on our Substack, and a chat feature for direct communication with experts and fellow subscribers. Stay informed, mitigate risks, and make smarter investment decisions. Subscribe now to access invaluable insights and protect your investments from geopolitical uncertainties.

Thank you to our audience for your readership, interest and participation.

Who might benefit from this information?

Investment Analysts and Portfolio Managers: They need to assess the impact of geopolitical risks on various markets and sectors to make informed investment decisions and manage risk in portfolios.

Supply Chain Managers and Logistics Professionals: These professionals need to anticipate and mitigate risks that could disrupt supply chains, such as trade restrictions, political instability, or sanctions.

Risk Management Professionals: They focus on identifying, assessing, and mitigating risks for organizations, and geopolitical risks are a significant component of their analysis.

Corporate Strategists and Business Development Managers: They need to understand the geopolitical landscape to make strategic decisions about market entry, expansion, or withdrawal.

Economic and Political Analysts: Analysts who specialize in economic and political trends can use such data to provide insights and forecasts to their clients or organizations.

Compliance Officers: Ensuring that their organizations adhere to international laws and regulations, especially in regions with high geopolitical risks, is critical for these professionals.

Consultants: Management consultants advising clients on global operations, market strategies, and risk management would find this information invaluable.

Procurement Officers: They need to secure reliable sources of goods and services and avoid disruptions caused by geopolitical events.

Government and Policy Advisors: These advisors need to understand how geopolitical risks affect national interests and global economic stability.

Insurance Underwriters: They assess the risks involved in insuring companies operating in various geopolitical environments.

International Trade Professionals: They need to navigate and comply with varying trade policies and regulations influenced by geopolitical events.

Academic Researchers: Scholars studying international relations, economics, and business can utilize this data for research and teaching purposes.

Access to a live table that tracks these risks would enhance the decision-making capabilities of professionals across these fields by providing up-to-date, actionable insights.

Disclaimer: This information and material contained in this post is of a general nature and is intended for educational purposes only. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. This post does not constitute a recommendation or a solicitation or offer of the purchase or sale of securities. Furthermore, this post does not endorse or recommend any tax, legal, or investment related strategy, trading related strategy or model portfolio. The future performance of an investment, trade, strategy or model portfolio cannot be deduced from past performance. As with any investment, trade, strategy or model portfolio, the outcome depends upon many factors including: investment or trading objectives, income, net worth, tax bracket, suitability, risk tolerance, as well as economic and market factors. Economic forecasts set forth may not develop as predicted and there can be no guarantee that investments, trades, strategies or model portfolios will be successful. All information contained in this post has been derived from sources that are deemed to be reliable but not guaranteed.

Wow, what an undertaking and commitment.

Enriching read