How we are investing in the ‘Picks & Shovels’ of Artificial Intelligence

"In a gold rush, sell the shovels & Levi’s blue jeans"

Introduction: On Revolution & Opportunity

Revolutions are inflection points where a network of concepts and innovations converge, begging the deconstruction of outdated parts where new, more beneficial systems can be built in their place.

Zooming into the building of the new will reveal a hotbed of opportunity. Today, we are experiencing the most profound, exponential step in history amidst the building and integration of the Artificial Intelligence revolution. AI bends the very concept of commodity by commodifying ‘thinking power’ in a fashion that fluently solves for the problem of human limitation, including localized knowledge and processing power. Of course, human thought cannot be comprehensively replaced, nor would we want that, but today our focus will remain on the very real, happening impact of AI and the most prime industrial-investment opportunities available along the supply chain.

In a Gold Rush, Sell the Shovels & Levi’s Jeans

Think of the California Gold Rush - who made more money? The gold prospectors? No. In fact, it was the merchants selling the shovels and the Levi Strauss jeans!

If the gold is the goal, how do we get there? What is that process?

Then, how valuable is that supply chain?

That’s the exploration of today’s article. With technical analysis, we can confirm that some of the more obvious equities ‘going for the gold’ in the AI revolution have reached a saturation of value for the long term. What that means for us, who are interested in investing, is that these value-saturated equities are here to stay - but they won’t offer appealing financial returns to us.

We’ve outlined a step-wise framework that supports the supply chain of AI and equities along each layer. Let’s explore a handful of equities we’ve identified along this framework that show promise to offer growth or stable value as we collectively foray into the newest technological era.

In this article

The Obvious Choice: Here to Stay, But Not to Pay

Identifying the Pickaxes, Shovels and Levi’s of the AI Revolution

A Deep Dive on Data Centers

5 AI-Supportive Equities We are Investing In Along the Supply Chain, + 1 Honourable Mention

We’re a new economics and finance publication with a penchant for environmentalism featuring new releases every Thursday.

The Obvious Choice: Here to Stay, But Not to Pay

Chips! Chips! Chips! Ah, oy vey.

Processing power is at the crux of it all isn’t it? So, what’s the problem with looking at chips as an investment opportunity?

Artificial Intelligence (AI) chip companies like NVIDIA are valued at 10x the equity price of well known Oil and Gas companies even though both camps rake in comparable revenues. Through a lens of value-based technical analysis, we feel this puts these chip manufacturers ahead of themselves in terms of pricing and valuation, which doesn’t bode well as an investment play. Furthermore, given the trend of geo-political actions, there exists a risk of NVIDIA’s export markets to be restricted - this could curtail current levels and future growth of sales - see link here.

Let’s analyze NVIDIA’s 1 year chart (April 2023 to April 2024), posted below. Based on the virtually parabolic rise, we can see NVIDIA is likely marked for a downtrend, even if the price temporarily rebounds from its recent drop.

We see this same down-trending action in the AI Chip Company SMCI, echoing the same recent drop.

We think it’s a good idea to seek out investment opportunities in the “picks, shovels, tents and blue-jeans” of the AI revolution instead.

Identifying the Shovels, Pickaxes & Levi’s of the AI Revolution

So what are some of the other, hard-working supply chain participants that support AI?

Here are two of the heaviest hitters:

Data Centers & Sustainable Energy Supply*.

Today we will explore a special focus on equities that support Data Center Infrastructure.

First, let’s look at the landscape context of Data Centers and then we’ll get into supportive investment opportunities you may find interesting for your portfolio.

A Deep Dive on Data Centers

Let’s start with the basics.

So, what is a data center? Wikipedia defines a data center as “a building, a dedicated space within a building, or a group of buildings used to house computer systems and associated components, such as telecommunications and storage systems.”

Looks like a scene out of Ocean’s Eleven. That’s because data centers are definitely not new. They’re the fundamental housing for cloud computing - the reason you’re able to stream almost anything from your phone - at miraculous speeds to boot.

Still from Ocean’s Eleven.

Speaking of which, a tangential and crucial industry that supports this technology is cyber security. Something to touch on another day. You wouldn’t want this guy creeping around your data, would you?

Want to expand or brush up on your AI vocabulary? Check out this glossary of Artifical Intelligence terms to bring it all together.

A Bloomberg article sheds some light on data centers as a backbone component of AI. The author highlights that the perception of data center demand necessitated by AI is vastly underestimated. According to Brian Venturi, the founder of cloud-computing unicorn CoreWeave, the economic landscape grossly underestimates how much the demand for artificial intelligence is going to expand the global market for data centers over the next five years.

Brian Venturo, co-founder and chief strategy officer, said at a Bloomberg Intelligence summit on generative AI in New York: “The market is moving a lot faster than supply chains that have historically supported a very physical business have been set up to do,” he said, predicting more “megacampuses” that will stress power grids and spur political fights. “There are going to be some things that this industry is going to have to work through,” Venturo said.

Nvidia expects that $250 billion will be spent on data center gear annually for the purposes of AI.

Amazon.com Inc., the top provider of rented computing power and storage, plans to spend almost $150 billion in the next 15 years on data centers to meet the expected explosion in demand from AI tools. The existing infrastructure supplying electricity to current data centers cannot support their expansions at the moment because new transmission power lines and new substations need to be built or enhanced.

Another article boldly concludes: “A surge in artificial intelligence demand is sparking the need for significant upgrades to the nation's decades-old power grid as new data warehouses come online. Several of the nation's power grids face increasing power brownout/blackout risks during high-demand periods .. the potential for significant investment opportunities with companies that have high exposure to infrastructure, electrification, power grid, and energy.”

Chart Courtesy of MarketsandMarkets

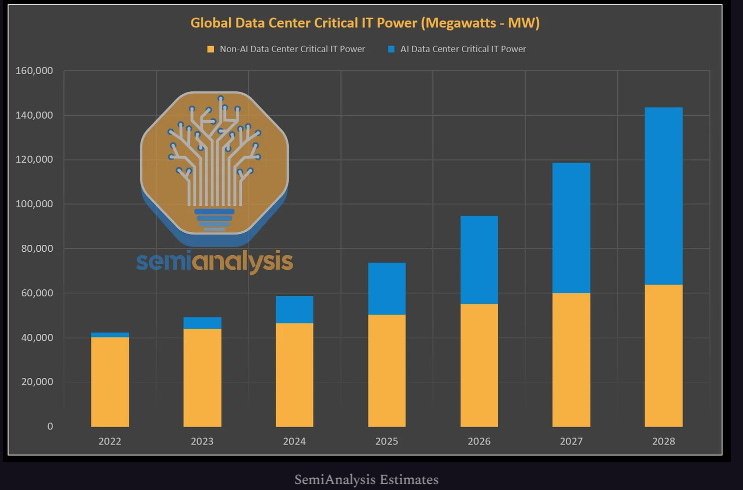

Finally, in a call back to the great need for sustainable, clean energy supply, we can see below the positive relationship between demand-growth on data centers influencing the demand-growth in power/energy:

Chart Courtesy of Semianalysis - see link also for more power analysis

In last month’s CedarOwl ‘Trends and Opportunities’ posting - on nuclear fusion energy - we noted how Sam Altman of OpenAI is bullish on nuclear energy as a solution to the USD $700,000 a day energy cost of generative AI to run ChatGPT. So energy related companies and investments will very much make sense in the growth of Generative AI.

Equities Along the AI Supply Chain

We Created an Industry Model That Helped Us Identify Today’s Featured Investment Opportunities

We have engaged in an industry analysis related to AI and have developed a framework model for the “picks and shovels” from the physical layer to the application layer for AI:

To this end, we have identified several public-exchange traded companies which offer the services and products at each layer but also meet our investment qualification criteria. Let’s take a look.