Goldman Sachs Identifies when the Rubicon was crossed - What Triggered Accelerated De-Dollarization away from the U.S. Dollar and U.S. Treasury Bonds

The Undermining of the Rule of Law has triggered Central Banks to buy Gold instead of U.S. Treasury Bonds

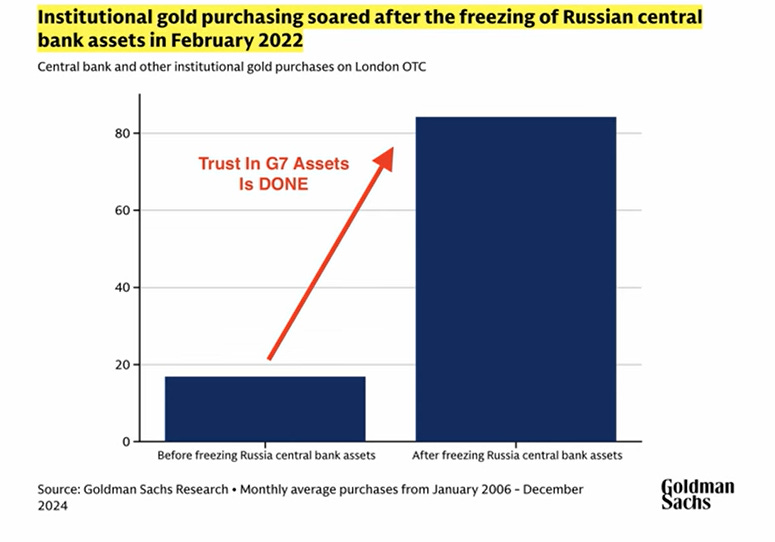

Goldman Sachs has identified what prompted a soaring of gold purchasing by institutions including central banks. Here is the chart below, courtesy of Economist Sean Foo. The demarcation point appears to have been the freezing of Russian central bank assets back in February 2022 when the war between Russia and Ukraine broke out. Led by the U.S., the G7 prompted a freezing of the assets, and later also appears to have moved to confiscate the proceeds (yield distributions on bonds) from the assets.

One of our Most Admired Advisors (MAA) Louis-Vincent Gave has mentioned this demarcation point on many occasions through podcasts and writings. Louis highlights the freezing and confiscation of assets and the undermining in general of the rule of law by the G7 countries. See or prior posts on this including but not limited to this one - Are Central Banks and Global Companies Diversifying out of U.S. Treasury Bonds - to U.S.$-backed China Bonds, to Gold, and to non-U.S.$ Currencies?.

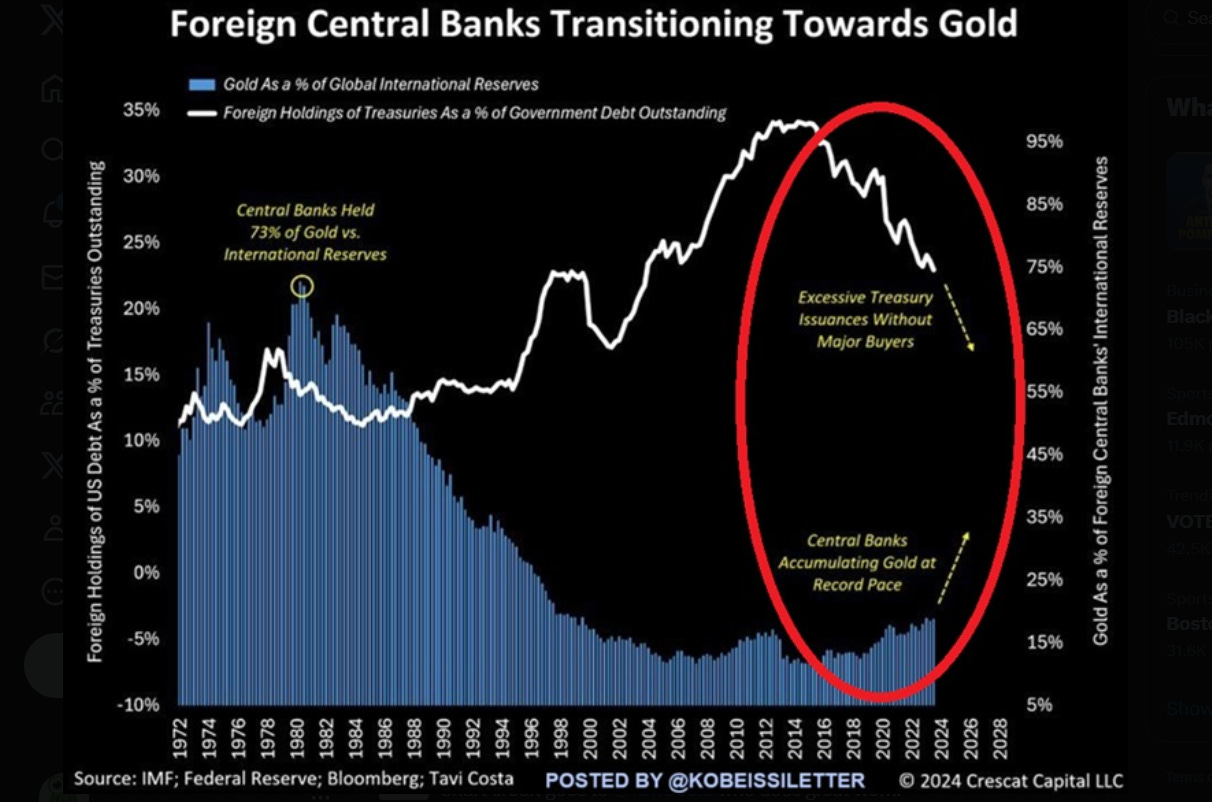

Louis would even go so far as to say the demarcation point started back in 2018 with China deciding to focus on industrialization and a diversification of trade away from the U.S., given the U.S. directive back then on the export of key semiconductors to China.

And the results are very clear - since about that time, foreign central banks are transitioning towards gold and away from U.S. Treasury Bonds. Gold is a neutral asset without political risks or geo-political ramifications.

Other Factors are Cementing the Trend

Of course there are several additional factors and considerations which are causing a loss of confidence in the U.S. and G7:

excessive and un-manageable unsustainable government debt and deficits;

changing, unclear and excessive tariffs being discussed, imposed and in fluctuation causing lack of clarity in the law for tariffs;

Section 899 of the Big Beautiful Bill (BBB) introducing punitive taxes on U.S. sourced income streams on assets like bonds or equities, and revenue streams like remittances relating to arbitrarily-identified countries which are “deemed” to have “unfair tax practices” (has been passed by the U.S. House but needs to be passed by the U.S. Senate to take effect).

Financial Repression will be used to drive a bid on U.S. Treasury Bonds

It has been our view that financial repression will be used to drive a bid on U.S. Treasury Bonds:

changes in financial/banking regulations on U.S. banks to allow, encourage or force additional purchases of U.S. Treasury Bonds

changes in the rules on registered accounts like 401K and IRA accounts to require account holders to purchase U.S. Treasury Bonds to maintain at least 50% of the total account market value in U.S. Treasury Bonds at all times

Become a paid subscriber today for access to the below, and to our entire postings, and to our model portfolios - for our best offer of less than $5 dollars a month - only $4.92 per month.

Disclaimer: This information and material contained in this post is of a general nature and is intended for educational purposes only. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. This post does not constitute a recommendation or a solicitation or offer of the purchase or sale of securities. Furthermore, this post does not endorse or recommend any tax, legal, or investment related strategy, trading related strategy or model portfolio. The future performance of an investment, trade, strategy or model portfolio cannot be deduced from past performance. As with any investment, trade, strategy or model portfolio, the outcome depends upon many factors including: investment or trading objectives, income, net worth, tax bracket, suitability, risk tolerance, as well as economic and market factors. Economic forecasts set forth may not develop as predicted and there can be no guarantee that investments, trades, strategies or model portfolios will be successful. All information contained in this post has been derived from sources that are deemed to be reliable but not guaranteed.