Is Capital Fleeing the United States?

Are global central banks and government selling U.S. Treasury Bonds? Is the trio of USD down, U.S. Equities down and U.S. Bond Prices down an Indicator?

Over the past couple weeks, the U.S. markets have been very volatile but a potential new trend needs to be followed closely as the implications are very dire for the U.S., especially given its target goal of re-shoring jobs and fostering a manufacturing renaissance.

The trend we speak of is capital leaving the U.S. - capital from savings, investments, equities, bonds and the USD. One early indicator is this chart from Bloomberg showing how the USD has been getting weaker but at the same time U.S. Treasury Bond yields have been rising, and actually this has been occurring even while U.S. equities have been selling off:

Here is a quote by “The Fed Guy” former Federal Reserve official Joseph Wang:

“The price action the past week is consistent with a foreign investor exodus out of dollar assets that could potentially be the beginnings of a currency crisis. Despite significant risk off moves in equities, Treasury yields actually rose notably throughout the week. The dollar depreciated significantly against major currencies even as it had recently strengthened in response to tariffs. Most alarmingly, gold emerged as the market's only safe haven asset.”

Global Central Banks and Governments Selling U.S. Treasury Bonds

Not only are global central banks and governments not buying much if any U.S. Treasury Bonds, representing unsustainable U.S. government debt, but they are even selling their existing holdings. Let’s look at the data.

Even traditionally friendly G7 countries are selling U.S. Treasury Bonds - Canada was the largest net seller in January 2025 - link here.

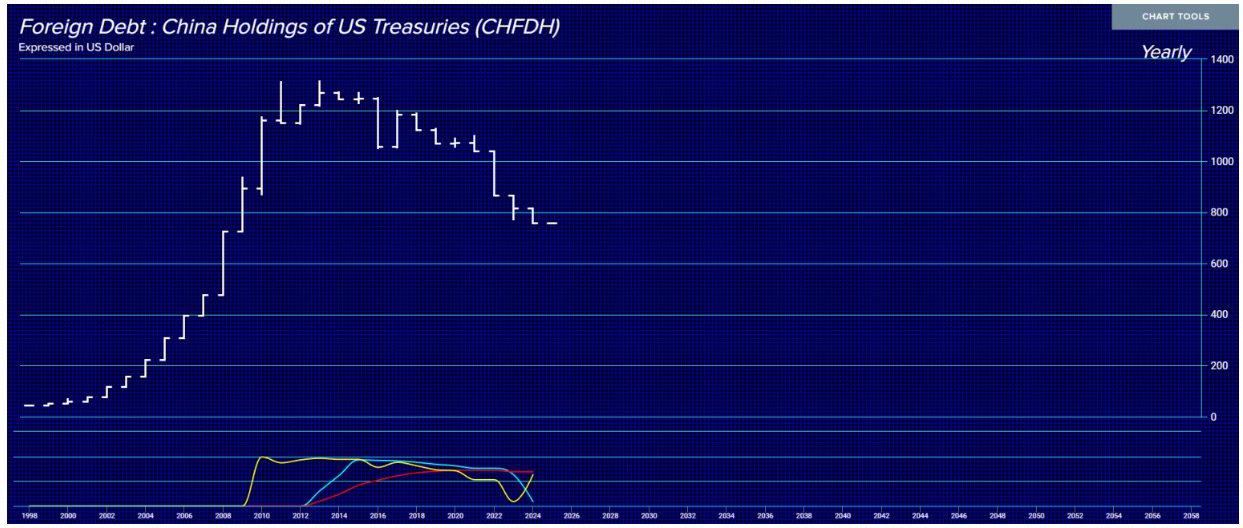

China selling of U.S. Treasury Bonds has been slow and quiet for many years already:

In prior posts we did point out how Japan is encourage its businesses to sell U.S. Treasury Bonds and repatriate the proceeds to help focus on business back in Japan.

What about China? Is there evidence of China selling its U.S. Treasury Bonds - well yes the above chart indicates “slow and quiet” selling over recent years.

Mizuho thinks China is selling its U.S. Treasury Bonds - link here.

Jordan Rochester, EMEA head of FICC strategy at Mizuho:

“Annoyingly we don’t get the data quickly enough, the data’s always lagged .. You’ve got the extreme tariffs on China and also future reciprocal tariffs that will be extreme on other Asian central banks and they’ve got to defend their currencies."

“You’ve seen a much slower pace of selloff in the renminbi than you’d expect, given the size of the shock to their system, so there’s clearly some sort of smoothing going on in the FX market, and to do that a central bank has to sell the US Treasuries and others to fund that FX intervention.”

“This is alarm bells, I think, for US Treasury Secretary Scott Bessent .. He’s now seeing a watering down of tariffs but still dollar weakness and US rates selling off still — it’s a horrible toxic combination.”

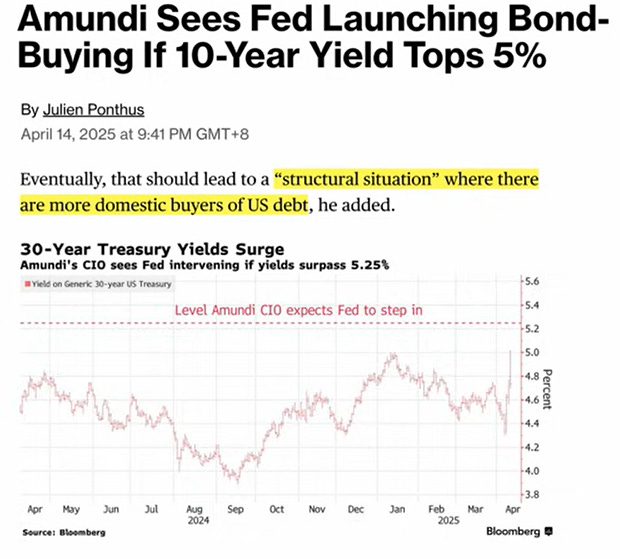

Given this trend plus the fact that the U.S. central bank, the Federal Reserve, does not yet appear to be instituting a monetization program to outright printing money out of thin air to buy the U.S. Treasury Bonds, the U.S. is now encouraging U.S. banks to buy more U.S. Treasury Bonds in exchange for reducing the burden of U.S.-focused banking regulations. Although if yields exceed 5%, then maybe the Federal Reserve would intervene:

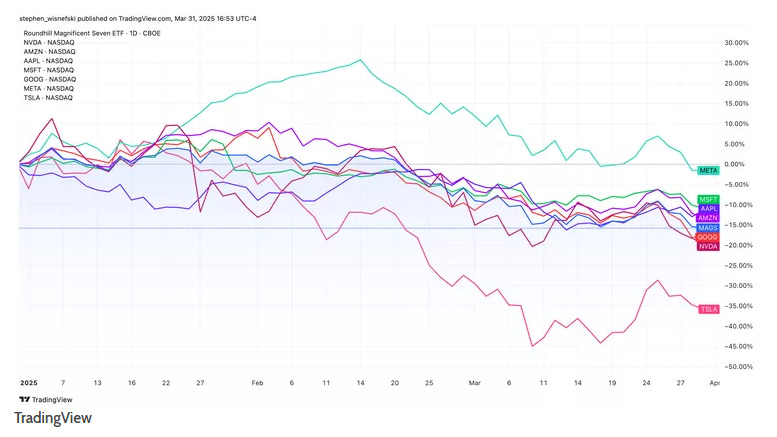

Selling of U.S. MAG7 Technology Equities

The selling is not just in U.S. Treasury Bonds. It is in particular to the MAG7 technology U.S. listed equities:

The concentration risk is enormous of foreigners having so much capital in the U.S. equities market - given that the U.S. is only 4% of the world’s population and only about 20% of the world’s GDP.

U.S. Net Treasury International Capital Flows clearly indicating capital flight out of the U.S.:

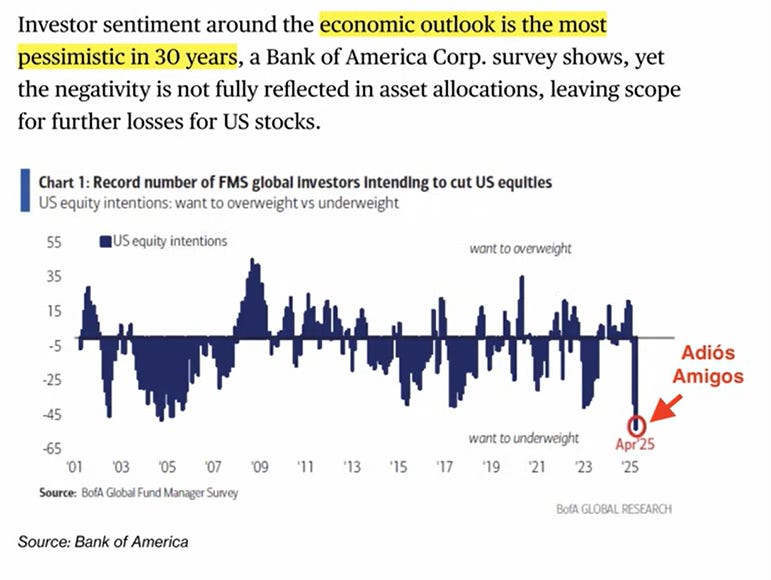

The selling of MAG7 equities on the U.S. equities market may not be limited to just these seven equities. Here is a chart indicating a general interest of selling U.S. equities in general:

Our recent article on What are International Capital Flows Indicating? is relevant to this discussion:

What are International Capital Flows Indicating?

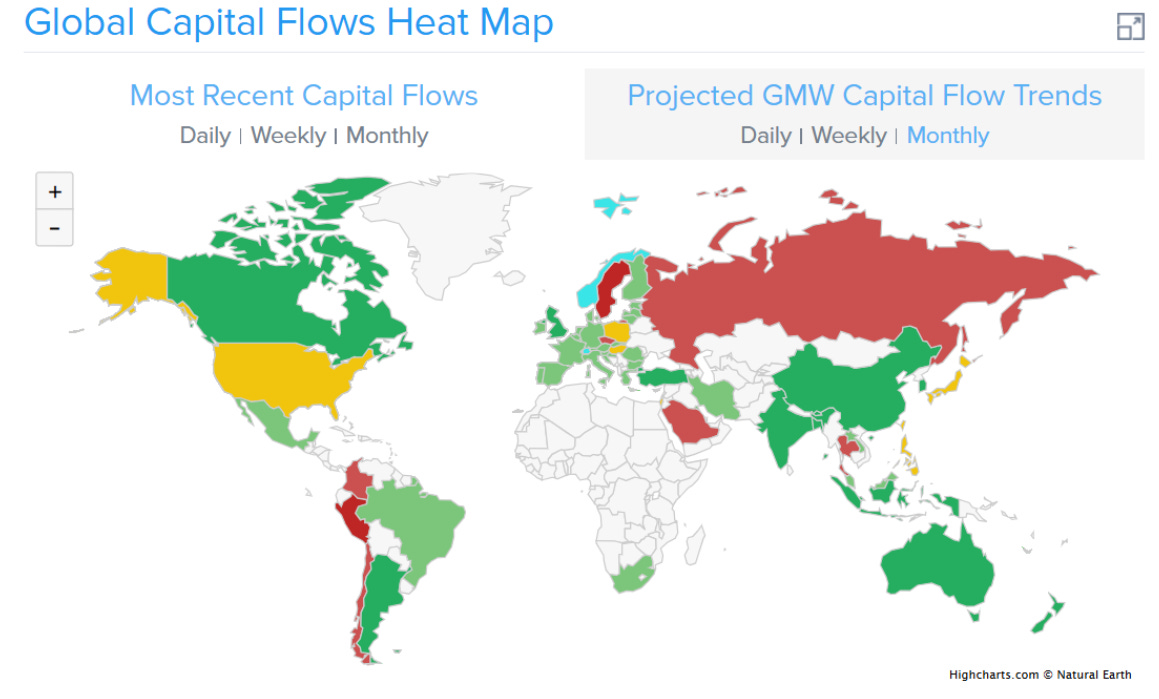

Where are investment assets flowing to? From which countries to which countries? How will these flows be affected in the event of escalating wars, such as in Europe involving Ukraine and Russia, or in the Middle East involving Israel and Iran?

Here is the International Capital Flows Map (as of the last week of March 2025), courtesy of Armstrong Economics - link here to find more about their services.

This is a projection of the coming near-term capital flows from a monthly indicator perspective.

Summary and the Implications on our Investment Approach

What do all these trends and developments mean to the economy and the investment environment? How is it affecting our investment approach? Let’s delve in …

Become a paid subscriber today for access to the below, and to our entire postings, and to our model portfolios - for our best offer of less than $5 dollars a month.