Is the U.S. getting desperate to find buyers of its U.S. Treasury Bonds to fund its debts and deficits?

Approaches include Default, Regulations, Trade Deals, Monetization, Inflation and other forms of financial repression including rule changes on 401K and IRA Retirement Accounts

With U.S. debts and deficits on an unsustainable trajectory - national debt well over $35 Trillion and rising, unfunded liabilities estimated to be as much as over $200 Trillion, and deficits rising - estimated to be potentially up to $3 Trillion this year alone, negating efforts by the new Department of Government Efficiency (DOGE) to cut deficits down to 0.

So how will or how can the U.S. address these debts and deficits? Especially when central banks are either not buying or even outright selling their holdings in U.S. Treasury Bonds, as we have extensively written about in prior postings - link here and link here.

We recently pointed out how China is now offering a substitute for U.S. Treasury Bonds. These are U.S. dollar-denominated, China-backed sovereign government bonds - we recently wrote about these, link here. So the U.S. Government now has to compete with China on the issuance of government bonds in U.S. dollars. Let’s look at the different avenues to address the massive unsustainable U.S. government debt.

Default

Of course one avenue is increased taxation - but this would be met with outrage by citizens who are already paying excessive levels of varying types of taxations.

Another avenue is to simply default on the debt by not paying back the interest nor the capital on the U.S. Treasury Bonds. This avenue is also highly unlikely as it would be met with domestic and global outrage with a loss of confidence and trust in the government, its institutions and in its legal infrastructure including property rights.

One scenario of default which has happened in history is during times of war, governments have often taken advantage of those time periods by defaulting on debt instruments held by enemies and foreign adversaries.

Regulations

Another avenue is to create new regulations or expand existing regulations to force institutions like banks, pension funds, insurance companies and other financial institutions to buy more U.S. Treasury Bonds in order to meet arbitrarily set compliance regulations. For example, on the Basel Accord regulation, forcing financial institutions to hold a certain level of assets, such as through buying and holding government bonds, to protect from “unexpected losses” in the financial institutions.

This avenue could likely be pursued by heavily indebted governments including the U.S. Government - creating new regulations or expanding existing regulations by forcing the buying of government bonds.

Strong Encouragement

Another avenue is to strongly encourage investors, especially foreign investors, to buy U.S. assets, in particular U.S. Treasury Bonds. Investors buying U.S. Treasury Bonds would directly address the challenge of the unsustainable U.S. Government debt.

Watch below the U.S. Secretary of the Treasury Scott Bessent below, imploring investors to buy U.S. assets, especially U.S. Treasury Bonds - link here. Bessent is nervously imploring as the realization of the depth of the unsustainable U.S. government debt becomes problematic to service, let alone to roll-over and prevent its growth:

Bitcoin and Cryptocurrencies

An interesting new development has been leveraging the global cryptocurrencies movement into helping to put a bid on U.S. Treasury Bonds to address the unsustainable U.S. government debt. Now that may sound crazy. Clarification is needed. We wrote a substack posting on this recently - here is the link or see below. We don’t think this avenue will be sufficiently robust to be able to address the full extent of the challenge of the great level of demand that is required for U.S. Treasury Bonds.

Will Cryptocurrencies Address the Unsustainable U.S. Debt Crisis?

As everyone knows, the U.S. is running unsustainable government debts and deficits. Who will finance all this debt? There are several data points and trends indicating how foreign governments like China and other countries are not only either not buying or buying less U.S. Treasury debt, but actually also selling their current holdings at the same time.…

Trade Deals

Trade deals is another potential avenue to put a bid on U.S. Treasury Bonds through trade negotiated deals with trading partners. This would mean the trading partners agree as part of the trade deal to purchase and/or hold a certain level of U.S. Treasury Bonds. This may come into play in the coming months as the U.S. negotiates with countries globally on trade deals.

Monetization

Monetization is generally the last option of monetary policy to address debt challenges. Monetization is essentially printing money out of thin air and using that money to outright purchase the U.S. Treasury Bonds on the market. This process is highly inflationary. This process may be coupled also in a monetary policy known as Yield Curve Control (YCC) - keeping the difference in interest rates on the yield curve generally constant. YCC is sometimes employed to keep interest rates at the long end of the yield curve, such as on 10-year bonds or 30-year bonds, at relatively low levels, in an attempt to not allow a crash in the bond market. Watch the below by podcast host commentator Maneco or link here to understand this process in more detail.

Financial Repression

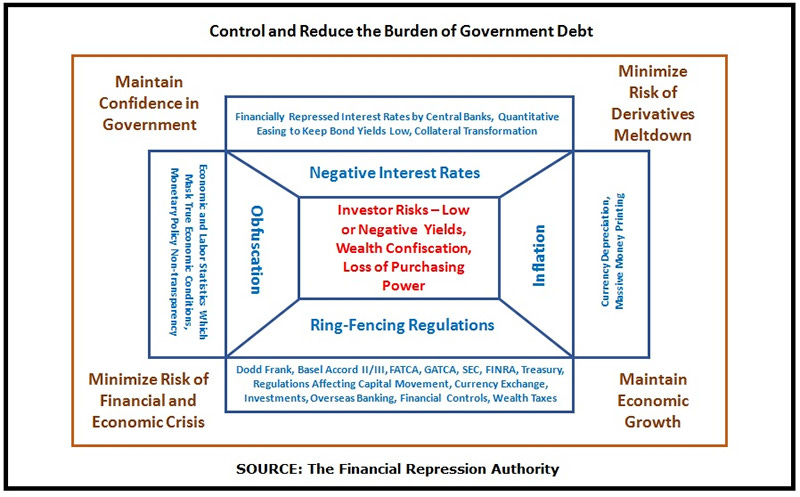

Financial Repression is the ultimate set of tools to address the challenges of unsustainable government debt. See below the chart illustrating the many tools which could be employed. For many years, the key tool used was a repression of interest rates at low levels to allow the servicing costs of massive government debt to be low and manageable. In recent years, the key tool now being used is a steady and relatively high rate of inflation over a long period of time, thereby reducing the burden of debt through a lowering of the purchasing power of the currency.

Changes to Rules in Individual Registered Retirements Accounts

Another tool of financial repression is the tool of changing the rules on registered retirement accounts like 401K and IRA accounts in the U.S. Essentially the government creates a rule such as “must have half of all assets in a registered retirement account in federal government bonds” to force individuals to invest in U.S. Treasury Bonds, perhaps also bolstering this rule with “do your patriotic duty” to help the U.S.. This would have disastrous effects on the purchasing power of the total portfolio value as you would essentially be forced to buy a declining asset in capital terms as well as in purchasing power terms (happening through inflation).

Implications to our Investment Approach and Portfolios

Let’s delve in …

Become a paid subscriber today for access to the below, and to our entire postings, and to our model portfolios - for our best offer of less than $5 dollars a month - only $4.92 per month.